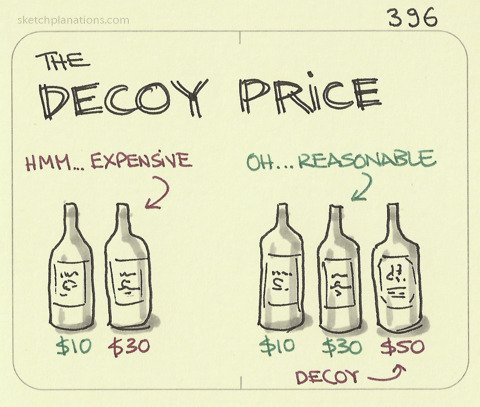

The decoy effect is a cognitive bias exploited by companies all around the world to trick you into spending more.

It’s so prevalent, that if you’ve ever watched a movie, bought a computer or a phone, or even ate at a fast-food restaurant – you’ve been a target of and a victim to the decoy effect.

Here’s the overly complicated definition from Wikipedia:

The decoy effect (or attraction effect or asymmetric dominance effect) is the phenomenon whereby consumers will tend to have a specific change in preference between two options when also presented with a third option that is asymmetrically dominated.

Didn’t understand much?

Allow me to illustrate it for you.

Let’s say you went to a fast food store, and the fries are sold in different sizes. You see two options:

Small Fries: $3 | Large Fries: $7

You would probably pick the small fries, because who wants to spend $7 on some fries.

But now, let’s say you see not two, but three options:

Small Fries: $3 | Medium Fries: $6.5 | Large Fries: $7

Which one do you pick now?

Most people would instead buy the $7 fries because they feel they’re getting a lot for the extra $0.5.

The original options are still around, and the $7 option only appears to be a winner because of how well it compares with the $6.5 option. Your brain’s comparison system has been tricked. You’ve been gamed.

Very few people will buy the medium $6.5 fries. The company did not intend to sell you the medium fries. They intended to use the medium fry option to get you to buy the large fry instead of the small fry.

People feel that they assign value to things in an absolute sense, that the item under assessment has an intrinsic value that does not change. The reality is, humans can only assess value on a relative basis.

The decoy effect works by setting the brain’s relative viewpoint on the decoy and tricking it into thinking that by spending a little more, it can receive a disproportionate return.

The next level of this effect is to use a decoy that’s worse in all metrics with one item, and partially better and partially worse with the other item (asymmetric dominance).

Mutual fund agencies and sellers of other financial products use this technique all the time to get investors to buy the product that nets them the highest commission. Let me illustrate:

Fund A: Annualized Capital Growth: 20% | Dividend Yield: 3%

Fund B: Annualized Capital Growth: 12% | Dividend Yield: 9%

Left on their own, some investors will prefer units of Fund A for its higher net return (20+3 = 23%), while others will prefer units of Fund B for its higher dividend yield (and consequentially, lower risk).

But let’s say the agency wants to ‘encourage’ investors to prefer Fund A because it offers them higher commissions. The agency then offers investors another option, Fund C (the decoy fund):

Fund A: Annualized Capital Growth: 20% | Dividend Yield: 3%

Fund B: Annualized Capital Growth: 12% | Dividend Yield: 9%

Fund C: Annualized Capital Growth: 16% | Dividend Yield: 2% (Decoy)

The addition of Fund C, which investors would probably avoid, is worse than Fund A in both growth and yield. In other words, Fund A asymmetrically dominates Fund C.

This tricks the brain into thinking that Fund A is vastly superior, and causes investors to choose Fund A (the dominating option) more often than they would have if they were presented with only two options (as above).

Alternatively, if the agency received more commission from Fund B, and wanted to promote it, it would use the Decoy Effect by offering the third option as Fund D:

Fund A: Annualized Capital Growth: 20% | Dividend Yield: 3%

Fund B: Annualized Capital Growth: 12% | Dividend Yield: 9%

Fund D: Annualized Capital Growth: 10% | Dividend Yield: 7% (Decoy)

In this scenario, Fund B becomes the dominating option as it beats Fund D in both metrics. The results are similar, and the decoy has increased preference for Fund B.

Again, the way this works is that the decoy acts as a basis of comparison for the other two options.

Take this example:

The option “Value Server” costs $119 and the option “Enterprise Server” costs $149. Clients that are indifferent between the ‘value’ and the ‘enterprise’ server will pick the enterprise server more often in the presence of the decoy “Power Server”.

~How do I avoid being gamed?~

Identify how much you need, so you don’t end up falling for I can get so much more for “only” $xyz extra.

Know that the natural tendency of your brain would be to fall for the trap. You will subconsciously use the decoy for reference.

If you want to avoid falling into the trap, you will have to deliberately consider another reference point.

Try to identify the decoy. In the process of decision making, you will have to actively not consider it. You will have to ignore the “medium fries” option.

And just like that, you’ve taken the first step to freeing yourself from the clutches of marketers.