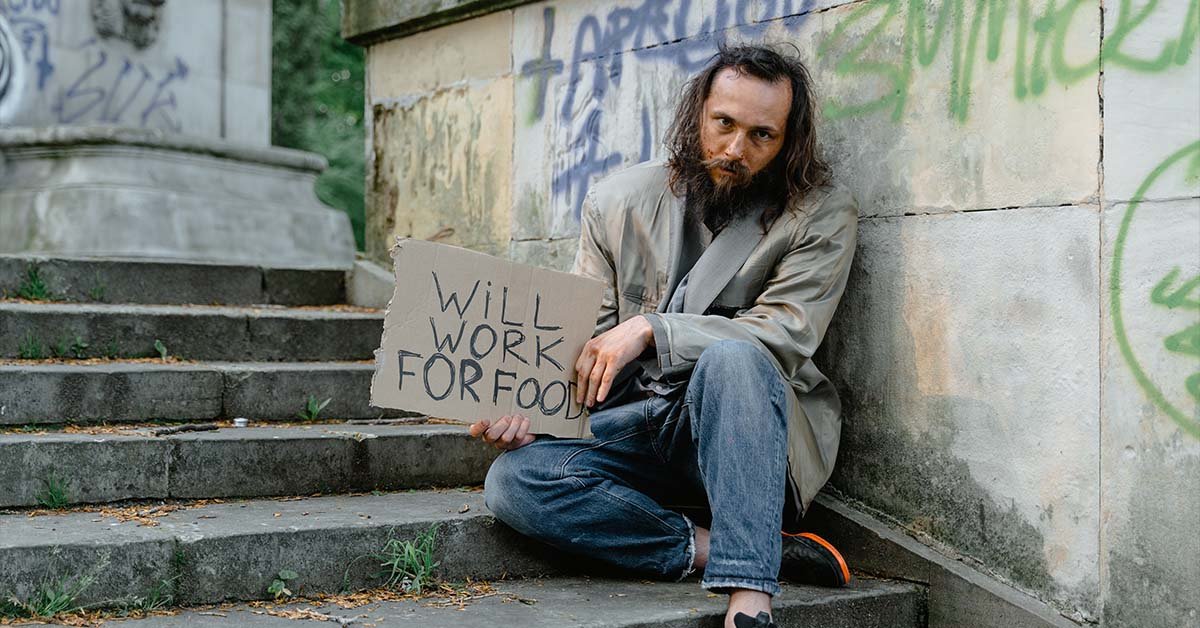

I received an email question from a reader who finds himself in a tight financial situation because of the pandemic.

“Hey, first of all I want to say your articles have been a real eye opener and truly valuable. Thanks for sharing them. However, I am mailing you to ask for advice. I will try to keep it as short and crisp as possible. I am mailing you about this stuff as I don’t have any father figure, or a mentor in my life with whom I can ask in this extremely difficult situation, rather a crisis, for guidance.

I’m Indian and am in my final year of my bachelors in an Indian university. I was the typical time wasting guy till my 12th. However, in my first year, we found out my father took a loan of Rs. 6 Lakhs (roughly $8000), and his business (it was already very poor, just providing for us) tanked and we were unable to pay it.

Recovery agents started coming and harassing us. At the same time, he suffered from Brain Stroke and even though, thanks to God he survived, he can’t work and is unemployed. My mother earns a meager ₹12,000 a month ($160).

So I got a job to assist my family, but then COVID happened and everything shut down.

Nevertheless, we survived because of my mother’s salary which was cut down to only ₹6,000 ($80) in the lockdown.

Now, am in my final year. And here we are, poor as dirt, may lose my father, may lose our house, and under high debt. I was so tense during that time with family, father’s health, earning and college studies that I never had time for anything else. I believe you’re from India, so you know the value of a [redacted on request – worthless degree] here. It’s already *extremely* hard for me to find a job. Cannot continue for further studies due to financial constraints.

So the thing I ask you is to simply guide me please. I am not a whining bitch. I am ready to put in my blood and sweat to pull my family out of this hell. But no matter how hard I look, I find myself in darkness. I tried searching online etc but it was of little help. Please, tell me where I can put in my efforts, help me or show me a direction and I will put my 100 percent. All I want is some advice from someone who is wise. Don’t have anyone in my family to ask so that is why I have to turn to the Internet.”

Okay, so this is a tough situation to be in. His dad had a stroke, his mom got a 50% pay cut, and he had to get an odd job to help with the bills. Not good.

Even by Indian standards, a monthly family income of ₹6,000 plus whatever he makes with his odd job (which I doubt is more than ₹10,000) is quite low, especially for a family of three with a sick member and a loan to pay off.

I have many young readers from India who might be going through the same situation because of the economic damage caused by the lockdowns, so I wanted to address it in an article.

Here’s what I would do:

Firstly, isolate the problem. The problem is not the loan and not his sick father (they are problems, but those problems are largely out of his control). The problem he can solve is his low family income.

If he could somehow figure out a way to make more money, he can comfortably pay for his father’s treatment and pay off the loan for his family.

So that’s the problem we’re aiming to solve – income.

His current situation:

- He’s working an odd job that makes him less than ₹10,000 a month (about $135).

- He has decent English skills, judging by his email.

- He has an internet connection (since he managed to send me an email).

We can work with that. Here is what I would do:

List yourself as a virtual assistant on gig websites like Fiverr and Upwork. Also, start applying for gigs on websites like Freelancer.

For inspiration, take a look at some listings.

You can initially charge something low like $5-7/hour, and as you get more gigs with time, increase it to maybe $10-15/hour (depending on how many gigs you’re getting and how busy you are).

It might take some time to start getting gigs, but you’ve got nothing to lose.

At worst, you’ll have to continue working your odd job. At best, you start getting clients and build yourself a decent dollar income that will dwarf your rupee income.

You’ll never get anywhere making in third world currency (as you are clearly experiencing – making $135 a MONTH), so your aim should be to try and get as much first world currency as possible.

Make the Fiverr and Upwork accounts, and start applying for online gigs on Freelancer. In your situation, any extra money you can make will go a long way.

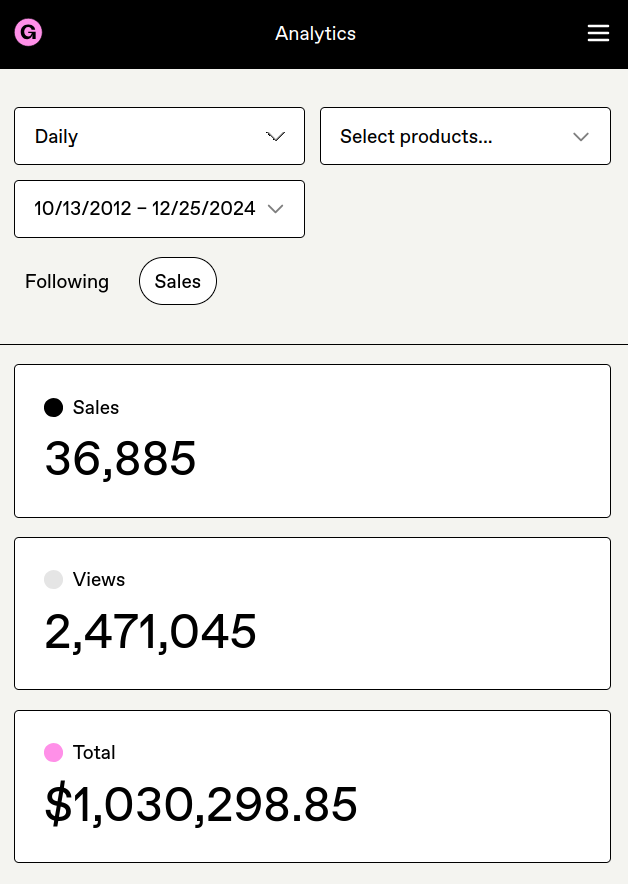

Your current monthly income is $135 a month. It is easy to make a good multiple of that online if you put your mind to it.

The biggest limiting factors are 1) never trying and 2) bad English skills – but you don’t seem to have either of those.

While you work as a virtual assistant, teach yourself some easy-to-sell skills like Photoshop graphic design. You can learn everything you need relatively cheaply from websites like Skillshare.

Once you become adept at graphic design and image editing, you can sell those skills on the same gig websites at a higher price.

This will take you from a time-based pay to a performance-based pay.

If you need reviews, reach out to influencers with a small audience (3,000-10,000 followers/subscribers) and offer to do some work with them for free in exchange for a review.

Send them an email suggesting something that could be improved with their website or social media design – and offer to do it for them for free. Keep building your portfolio and keep collecting reviews.

Your aim should be to get to $1000-1500 a month in about 1 year, which is not difficult.

Once you get there, your life should be far more comfortable than it currently is.

Use the money to help your family and pay the loan and for your education. Budget and don’t waste a single rupee until you’re out of this situation.

Also, try to talk to the lender and renegotiate the loans. Lenders become more cooperative when they know that not cooperating means bankruptcy (i.e., in which case they get nothing).

Hope this helps.

– Harsh Strongman

![Traits Women Find Attractive Traits Women Find Attractive (And How to Score Yourself) [PART 1: Physical Aspects]](https://lifemathmoney.b-cdn.net/wp-content/uploads/2025/11/Traits-Women-Find-Attractive-1.jpg)