When most people think of slaves, they think of black people in America being whipped, tortured, and raped by their white masters.

That’s one form of slavery and it’s called chattel slavery. There are many other forms of slavery (chattel slavery being the most extreme).

On the other end of chattel slavery, you have the Greek slaves who had property rights, vacations, and could buy their own freedom.

Here’s a few more types of slavery:

- Debt Bondage where someone is forced to work to pay off a loan (think of the guy who can’t quit his job because he has to pay his student debt)

- Forced Labor where someone is forced to work against their will (think of middle eastern labourers who have their passport confiscated by their masters)

- Sex Trafficking where someone is used as a prostitute for commercial gain

- Domestic Servitude where someone is forced to work in private homes (think of children and women who get married by force into uneducated labor families)

This isn’t an exhaustive list but you get the point – there is much more to slavery than a white guy whipping you and forcing you to pick cotton.

Here’s a new type of slavery that was born just in the last century:

Tax Slavery

If you live in a high tax country, you are a type of slave but you don’t realize it.

Think about it.

I’m going to use India as the example in this piece because I know a lot more about the Indian tax system being a CA myself and owning a tax/law consulting firm.

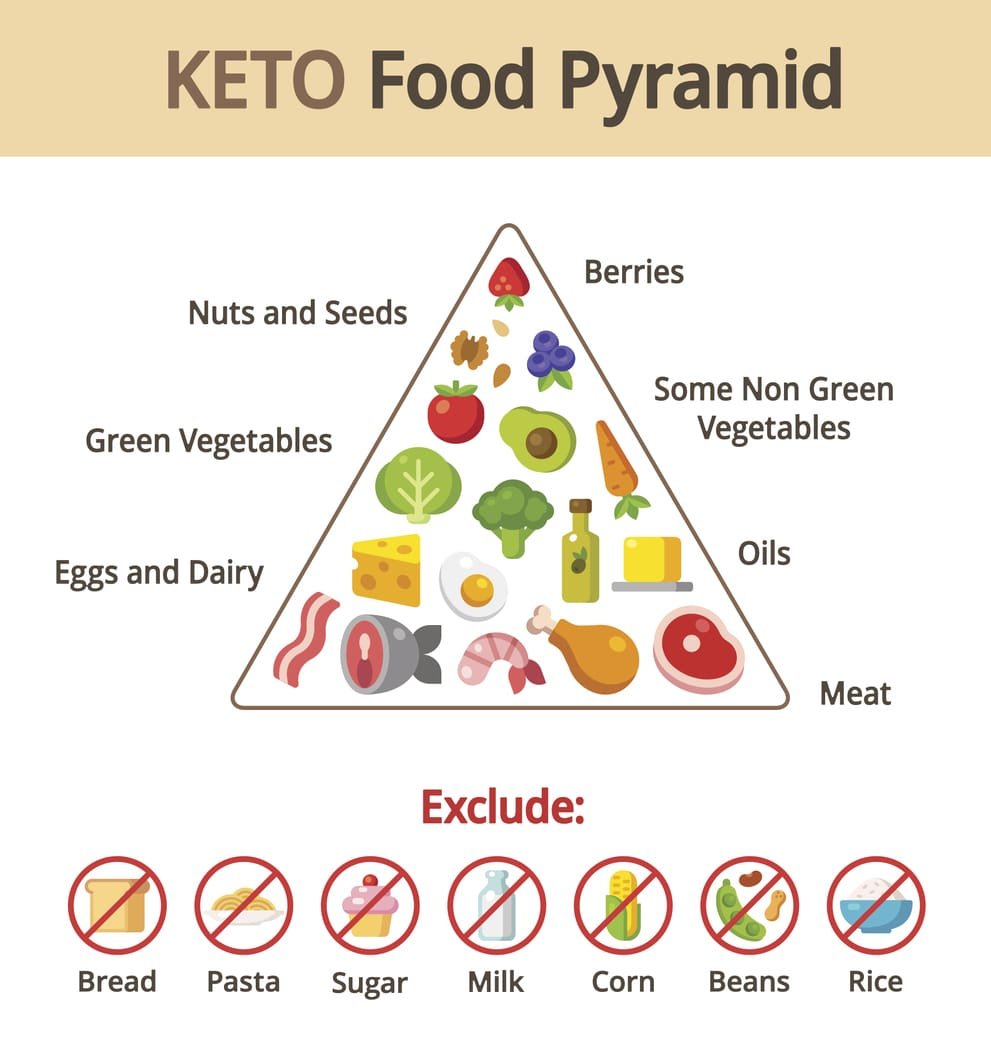

You have about 35% in Income taxes (counting in the tax rate, surcharges, cess, etc.). This is what most upper middle class salaried people pay. (If you make a lot more money, the highest rate is ~43%. But 35% is what most salaried professional pay, so let’s go with that.)

Then you have 18% in GST (sales tax). You pay this on most things you buy. If you buy something worth ₹100, you have to pay ₹118 after GST.

Do the math. If you earn ₹100, how much do you actually get to spend?

After income taxes, you’re down to ₹65.

Then you take your post-income-tax money and buy something with it.

After the 18% GST, it turns out you can only purchase ₹55 worth of stuff (65/1.18).

That’s about half your money gone in taxes. And that calculation only works for general purchases like electronics and groceries.

What if you want to buy a car?

You’ve got to pay :

- 28% GST on base price

- 17% Cess on base price

- 18% GST on Insurance

- Road Tax and Registration charges

- etc.

Do the math and see how much money you actually get to spend from the income you earned from your hard work?

What if you save all your post-income-tax money for years and years to buy a house?

Congratulations, you have to first pay a big registration tax (aka stamp duty which is a few percent of the price of the property).

Then every year you also have to pay from your already tax paid money:

- Property taxes

- Municipal taxes

- and a thousand other types of taxes.

Most people get to use less than half of the money they spend. The rest of it goes to the government.

And I haven’t even accounted for inflation, a type of secret tax on everyone who isn’t asset rich.

If you work 12 months in a year, 7 of those months you are working for the government (if not more).

For every bit of work you do, more than half the gains go to someone else.

That is SLAVERY. There is no other way to put it.

You are losing MORE THAN HALF OF THE REWARDS of your hard work to taxation.

This is not your “fair share”. This is the government extracting an unfair share out of the productive people and giving it to the unproductive people.

When I say this, I get the middle of the bell curve types tell me “Taxes is why you have roads, space programs, and hospitals” but let’s look at where the money actually goes.

Once again we will stick to India because I know more about the Indian tax system than that of any other country, but this stuff is universal.

Where the Tax Money Goes

Budget for:

- Defence Research and Development Organisation (DRDO): ₹24,000 crore

- Indian Space Research Organisation (ISRO): ₹13,000 crore

- Budget for education and skilling: ~₹1,48,000 Crore

Now most of us would consider these things productive and paying for this would be “fair” to most people. If we were only paying for things like education, defense, research, etc. I would not call taxes a form of slavery.

But let’s look at some of the other things:

Maharashtra’s Ladli Bahin Yojna: ₹46,000 crore

This is free money in your bank account simply for being female. It’s larger than the DRDO and IRSO budget combined.

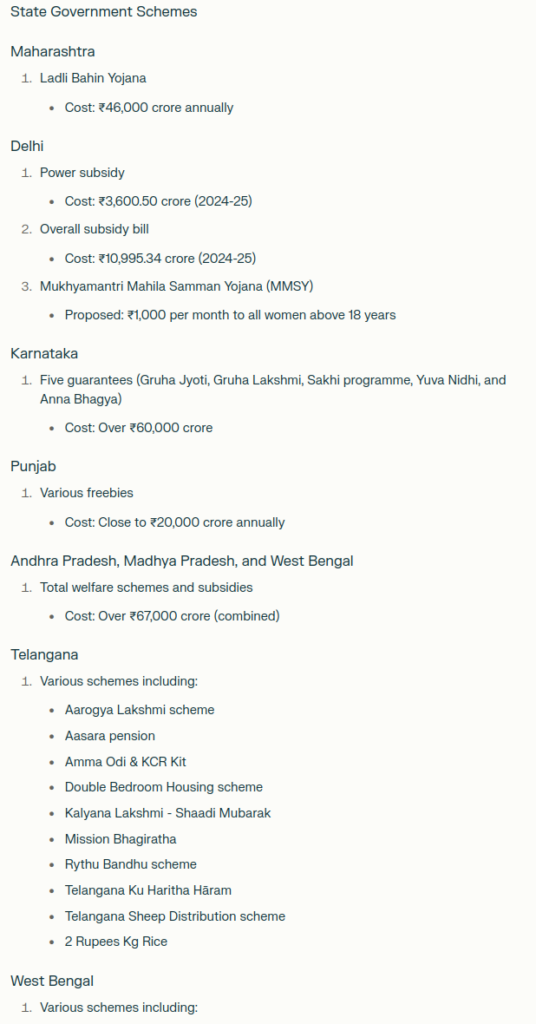

And it’s only the budget of 1 of 28 states. Almost all states are running similar freebies and you can imagine how much the total budget for all states would be.

I asked Perplexity to make a short list of these freebie programs and here’s what I got:

Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY): ₹11,80,000 crores (over 5 years)

Pradhan Mantri Kisan Samman Nidhi (PM-KISAN): ₹60,000

National Rural Employment Guarantee Act (MGNREGA): ₹96,133.76 crore (for the state of Bihar alone in 2024-25)

Delhi Government Schemes:

- Power subsidy: ₹3,600.50 crore (2024-25)

- Overall subsidy bill: ₹10,995.34 crore (2024-25)

The list went on and on.

If you do the math, only a tiny portion of the tax you pay goes to the things you care about.

Most of what you pay in taxes just becomes free money and stuff for unproductive people. Freebies.

I know people who do zero work but live a leisurely life because they get enough money from various government schemes to live a comfortable life. They just watch TV and relax.

In the meantime, you work day and night only to pay for their lifestyles.

WHY?

Because you are a slave. You are a TAX SLAVE.

High taxation is a form of slavery.

You are not getting things valuable to society for your tax money. You are not getting lots of education and good roads and infrastructure.

The majority of your money is being spent on… funding the lifestyles of lazy and unproductive people.

The politicians do it because they get votes by giving out freebies.

But why are YOU ok with getting exploited like this? You should be pissed off.

Never feel bad about minimizing your tax liability.

Do EVERYTHING you can to legally minimize your payment to unproductive people.

- Use tax loopholes as much as you can

- Structure your business such that your tax rate is lower (For example, ask to be paid as a contractor instead of an employee so you can take your expenses as deductions)

- Incorporate new ventures in tax haven countries

- Pay only the sales taxes of your own country

- Build a business instead of working a job (Lowest net tax rates by far. Ask Warren Buffet who famously said that he paid a lower tax rate than his secretary)

Just make sure you do everything you can LEGALLY because breaking tax laws eventually catches up to you.

Don’t let the middle of the bell curve people make you feel bad about not paying your “fair share” (100% of the people who use this term unironically are middle of the bell curve).

You can just laugh in their face because what would you if a slave came up to you and told you that it’s good to be a slave and immoral to be free?

You would laugh in his face (and maybe pity him a little).

I would laugh so hard in his face that my stomach would hurt.

I pay very little in taxes (Think the low single digits).

I keep most of the money I earn.

It’s through the sweat of my brow that I earn my income and I do not wish to give it to politicians to steal and distribute among the unproductive in exchange of votes.

If you pay high taxes and think you’re “more moral” for doing it, you’re the slave who think that it’s good to be a slave.

If you pay high taxes and think I’m doing something wrong by not being exploited like you are – my friend, all I can do is… laugh in your face.

Hahahahahahahahahahahahahahahahaha

I do feel some pity (and contempt) that you’ve made your peace with slavery and learned to love it, but man, it’s so funny. All I can do is laugh.

HAHAHAHAHAHAHAHAHAHAHAHAHAHA

– Harsh Strongman