At all times, you must strive to have at least one year worth of essential expenses saved up.

Before we get to the why part of it, let’s first compute what the number is – you will need a paper and a pen (or an excel sheet or whatever).

Figure out your monthly burn rate, i.e. how much money you need to survive for a month (the cost of a basic lifestyle).

We’ll take the big items:

- Housing

- Food and Groceries

- Conveyance / Fuel

- Utilities (electricity, water, etc.)

- Internet and Phone

- Other Miscellaneous Items (10-15% of the sum of the above)

(We’re assuming that you don’t have debt. If you have debt, pay that off first.)

The figures vary wildly depending on where you live, so you must run this calculation for yourself and find out your number.

At a minimum, aim to have 12 times (1-year worth’s) this amount saved up.

Reasons to Save Up a Year’s Worth of Expenses

1. Protection from unpredictable events

The main reason to save up a year’s worth of expenses is to protect yourself from the impacts of unforeseen events.

If you lost your job, you wouldn’t be forced to reach out to friends and family for help.

You also wouldn’t have to accept the first job offer you manage to get because you needed the paycheck to pay the bills next month.

If you fall sick, you won’t have to worry about how you’re going to pay for treatment and care.

Some curveballs life throws at you are hard already, but not having some money in the bank makes it 100x harder.

Having some money in the bank gives you some insulation from events that would otherwise be catastrophic.

2. Lower stress levels

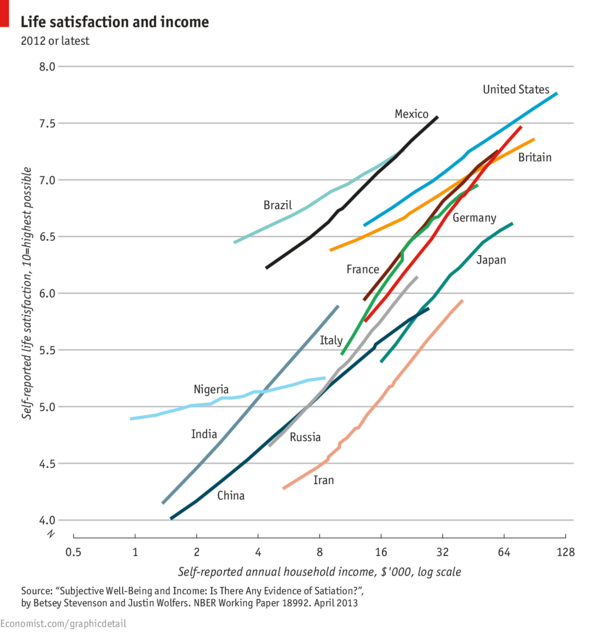

Money lowers your stress levels. This is not to say that money solves everything, but data shows that families that make more money tend to be happier.

When you know you don’t have to worry about paying the bills – your stress levels will decline.

When you know you won’t need to beg, borrow, or steal if you lost your primary source of income – your stress levels will decline.

When you know you’re not living on the edge of your bank balance – your stress levels will decline.

It’s much easier to be calm and happy when you don’t have to deal with money problems.

3. Liquidity to get into the market if (when) it crashes

Money in the bank will give you access to new opportunities that others aren’t able to take because they don’t have the cash.

Let’s say the market crashes (it’s going to happen eventually) – asset prices are below their intrinsic values and everything is undervalued.

Most people are scared and bleeding money – declining values of investments, worrying about potential layoffs at their company, etc. – they can’t get in because they don’t have the disposable liquidity.

If you’ve got some cash lying around – these points are literally the best times to go and buy as much as you can. Sink your teeth in and grab a piece of the rebound.

4. Keeps you from being boxed in

Money gives you the most crucial piece of leverage in any negotiation – the option to leave the table.

When you’re living paycheck to paycheck or close, it’s next to impossible to quit your job even when you’re not happy because you have to put food on the table.

If you have that cushion in the bank, you can tolerate a few months of downtime as you search for a better job with better prospects.

You are no longer chained to your situation because of bills and obligations – you are free.

Further reading: Why You Should Start an Internet Based Business

Hope this helps.

Your man,

Harsh Strongman

![Traits Women Find Attractive Traits Women Find Attractive (And How to Score Yourself) [PART 1: Physical Aspects]](https://lifemathmoney.b-cdn.net/wp-content/uploads/2025/11/Traits-Women-Find-Attractive-1.jpg)