One of the biggest financial mistakes men make is dying with lots of money in the bank. Let me tell you how this plays out with a real example.

For many years, I had an older client who needed my help with tax management. Let’s call him Gurmeet.

Gurmeet had been our client for as long as I had been a tax consultant. He originally hired my father when my father had started the tax practice soon after quitting his job at the factory. When I grew the firm into a corporate practice, I did retain some of these older clients simply out of sentiment (the revenue from them is fairly minimal).

Gurmeet was in his 60s and had two daughters who lived in Canada. One had married a Canadian and become a citizen there.

His other daughter was sleeping with random men and getting older with no signs of a stable boyfriend to marry. He had complained about her antics to me before and I had politely explained to him that he was the problem.

Gurmeet grew up in his village in Punjab and had lived a hard life. He had a healthy respect for money and saved up as much money as he could.

Even when he was no longer poor, he did not spend his money. He did not buy expensive cars or take exotic vacations. He lived in a shitty 1BHK apartment in somewhat run down building.

When he did travel, it was usually to visit his daughters in Canada. It was a long haul flight but he always flew the cheapest airline. He literally carried his own food on the flight because he thought airport food was overpriced.

He worked hard, saved up all his money, and invested it in gold and stocks. He loved gold and in the last few years, he saw the value of his ETFs soar higher and higher.

He didn’t spend his money for his enjoyment. He wisely invested it like how everyone (except me) told him.

90% of his money was in his investments (which were soaring), and the rest was his shitty small 1BHK house.

A few months ago, early in the year, he died. As usual, it was a heart attack.

One of my father’s first few clients, and one of my oldest clients, was dead. He left behind a lot of hard earned but unenjoyed wealth in the form of his house, his gold ETFs, and his stocks.

We only heard that he was dead when his daughters came from Canada to visit me.

After I verified that they were actually his daughters, and confirmed that Gurmeet was dead from a mutual friend, we got down to business.

Gurmeet’s daughters had finished their father’s last rites last month, they had sold his house (quite cheaply because they wanted to get rid of it fast so they could go back to Canada), and had come to me to help them with transferring the investments to their names.

It was a simple process because Gurmeet had nominated them when he made the investments. Once the transfer was done, I helped them sell all the investments. They didn’t care about the future potential of gold or any of Gurmeet’s stocks.

They just wanted to get all the money, convert it all to Canadian dollars, and go back to Canada for good.

Now before any of you assume the daughters didn’t love their father, let me tell you that they were not uncaring daughters. They loved their father and it showed. When he was alive they visited him and paid for him to live with them in Canada.

But what could they do now that he was dead? They had jobs and lives back on the other side of the globe. And they couldn’t afford to keep coming back to India to upkeep a shitty 1BHK apartment. Encashing the house and investments and taking the money to Canada was the rational choice.

All the investments their father had made so painstakingly, with love and care, and the shitty ass house he lived in, and the shitty ass life he lived because he was too cheap to spend his money – were all gone in an instant.

His house sold for a price that would kill him twice if he learned of the sale. His investments sold at a time they were truly taking off. His life over before he could enjoy any of his many decades of hard work.

His two daughters sold it all, split it equally among themselves, and went on their way back to Canada.

I added them on Instagram, and was amused enough to write this article when I saw their newest status.

The older one seems to have spent her father’s money on interior decoration for her house. I’m talking very expensive furniture. The younger one is on a Europe trip with her new “boyfriend”.

It seems like Gurmeet spent all his life saving money to fund his daughters’ shopping sprees and international vacations.

Why had he not spent and enjoyed his money while he was alive? The answer is that he was a pussy who was addicted to saving money and living a shit life.

It takes wisdom to save money, true. But it takes balls to spend money. It sounds like bullshit but it’s true.

You need balls to spend money and enjoy your life. Something many old people desperately lack.

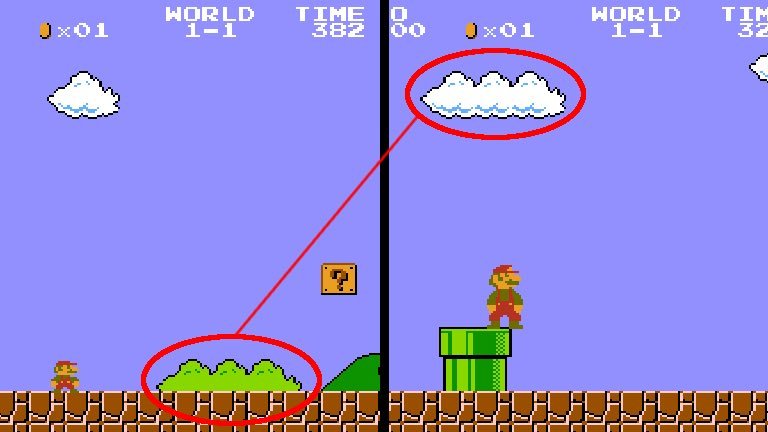

Real money is like video game items. It only has value for the duration of the video game. If you always save your best equipment, weapons, and money till the very end, and then the game ends with you never having used them, it is almost as good as if you never had that equipment, weapons, and money in the first place.

Leave enough for your children so that they can play the game with a fair chance, but not so much that they can choose to waste their lives instead.

Instead of leaving them tons of money, give them skills, values, and the MINDSET so they can work and make their own money.

SPEND YOUR MONEY AND LIVE A GOOD LIFE. This is what I tell almost all my older clients.

Get a good house, travel, have fun, and enjoy your time on the planet. After all that’s why you made money, right? You didn’t work this hard just to die with paper investments.

If you are happy with what you have, then stop working extra hard to make even more money. Live a leisurely life. Do things you like. You’ve only got so many years left.

If you want to give money to your children or whomever else, give it to them while you are still alive. This way you can actually make sure they use it properly (investments, house, grandchildren’s fund, etc.) instead of wasting it.

If not, I can pretty much guarantee that someone else will spend your money for fun, and they will squander it far more than you ever can.

– Harsh Strongman

![Traits Women Find Attractive Traits Women Find Attractive (And How to Score Yourself) [PART 1: Physical Aspects]](https://lifemathmoney.b-cdn.net/wp-content/uploads/2025/11/Traits-Women-Find-Attractive-1.jpg)