Subj: How to thrive during a recession and prolonged high inflation (Prepare for a recession)

From the desk of Harsh Strongman

For those of you new to this website, I’m Harsh Strongman. I’m a self-taught computer scientist, entrepreneur, chartered accountant, blah blah blah.

I own:

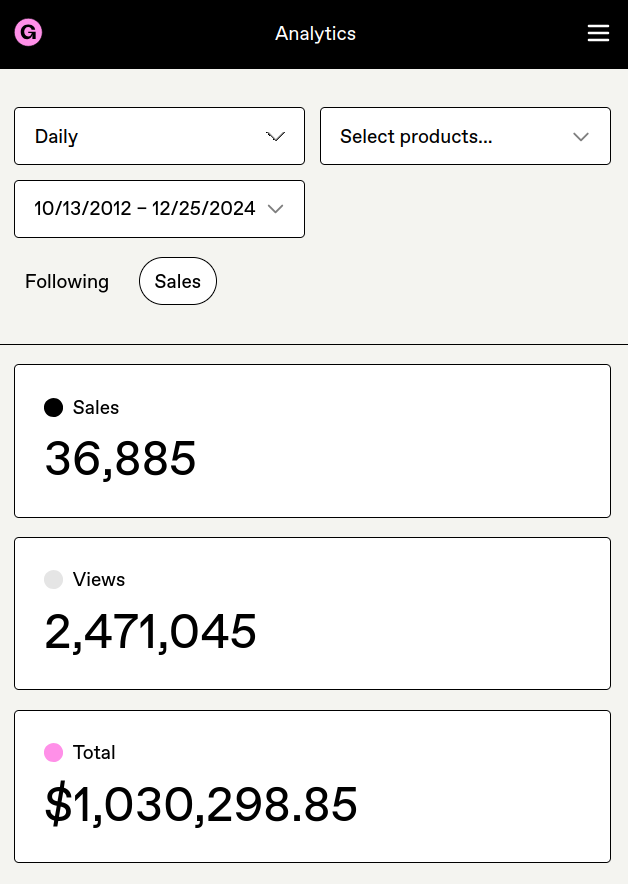

1) Life Math Money, the #1 Self-Improvement Website for Men (you’re reading this right now)

2) Teach Yourself Crypto, the #1 Free Crypto Course on the Internet

3) An affiliate marketing business

4) A SaaS company that handles digital copyright protection

I used to be a financial and legal consultant before I got into the world of online business.

I became a millionaire at the age of 24. The reason I’m telling you this is not to brag, but to tell you that I know what I’m talking about.

The next 2 years are a huge opportunity. If you pay attention to this article and make use of the next 2 years, you will end up a decade or more ahead of everyone else.

If you don’t, then you will be much behind your peers who didn’t waste the opportunity.

We are in a bad economy right now. We’re seeing low to no growth and record high inflation i.e. stagflation. The official government inflation rate is about 10% but the real rate is closer to 25%.

There will be more pain as the full impacts of the multi-year lockdown and money printing take their toll.

You need to prepare for the recession. There are things you can do today to 1) Minimize pain and 2) Position yourself for big success in the next bull run. So let’s get started.

How to “Make It” in a Recession

1. Realize that this is not the end of the world

It’s important that you realize that the world is not ending. It may feel like it – especially if this is your first economic collapse – but we’ll be fine and things will be better in time.

Recessions have happened many times in the past.

The 2008 housing market crash was a terrible time for the economy. Normal people lost their jobs, their savings, and their houses in foreclosures. Even some banks went bankrupt.

It was 2 years of massive pain for many people, but was then followed by the longest bull run in history.

People who started a business or made investments during the 2008 crash rode the entire 10+ year bull run that came after it. They made out like bandits.

Likewise, the Dot-com bubble crash of 2000 was a bad time. Many so-called “revolutionary” companies went bankrupt. People thought it was the end for tech.

In fact – and as we know now, the era of tech had just started. Today, tech is the biggest industry sector by weight in the S&P500.

If you’ve been in tech from 2001 and onwards (investor, entrepreneur, or employee), you’ve made a lot of money – much faster than the rest of the population.

We’re in a poor economy once again.

And once again, this is not the end of the world, even though it may feel so.

If you read history, you will find that these crises are opportunities. You can use the time to set yourself up for enormous success in the years of prosperity that follow recessions.

It is important to keep that in mind.

Keep a Winning Mindset

There is going to be a lot of pain in the near future as things get worse before they get better.

Keep in mind that this is a time of opportunity. This will help you 1) Be more positive and have a “can do anything” mindset and 2) Spot more businesses and life opportunities to capitalize on. (The already successful readers will recognize that this is a positive feedback loop.)

Repeat after me: The economic downturn is an opportunity for me to get rich. I can use this time to position myself such that when prosperity returns, I can capitalize on it hard and early and be set for life.

If you waste the next 2-3 years, you’re going to end up years and decades behind the people who didn’t.

P.S. History repeats itself. If you want to know how governments respond to a long recession, read The Great Depression: A Diary (India, USA). The short one-line summary is “They’re going to print an absolute ton of money”.

2. Don’t Sell Existing Blue-Chip Investments Even if They’re Down

I was only a teenager when the crash of 2008 happened. I remember my family panicked when the stock markets plunged. They sold all the investments they had at massive losses.

Over the next few years, the prices of those very assets rose back again. If they had held on to them, they would have made a tidy profit.

People lose money in the stock market because they aren’t able to control their emotions. They panic when prices drop and sell everything.

Not only do they sell at a loss but they also get to watch the markets recover after they’ve gotten out (very painful).

Look, the way governments always handle economic downturn is by printing a lot of money.

This creation of new money with no increase in assets is the reason inflation happens. Prices rise as more money chases the same amount of goods and services in the economy.

Sooner or later, a lot of this money ends up in investments – stocks, crypto, houses, etc.

Once the downturn ends, it is inevitable that asset prices will recover and reach new highs. This is simply because the value of money keeps on falling.

Unless you have a better use for the money, there is no point in selling your investments. Over time, the cash will be worth less and the investments will be worth more.

Why Blue Chip Only?

The only thing you want to avoid is what I call “going bankrupt” situations.

For what I said to work, the company has to be around after the downturn. If you think a company might go bankrupt or otherwise liquidate, sell it and buy something else.

Things will be better. Markets will be back up. The future is bright.

Just avoid things that have AIDS and are going to die in the downturn – like pets.com and LUNA.

Keep the blue chip stuff and you should be fine for the most part.

P.S. Blue chip = High quality assets that are likely to stand the test of time.

This means companies with established and stable businesses like Google and Amazon.

In the cryptocurrency world, it means established assets like Bitcoin and Ethereum.

You want things that will stand the test of time and not stuff that will go bankrupt and to zero.

As a side-note, there are no blue chip bonds. Bonds pay in fiat currency and fiat currency is the worst asset of them all – it’s guaranteed to go to zero.

3. Don’t Hold Cash

The value of fiat currency falls over time because of inflation.

Study the history of money. Any currency that governments can issue out of thin air goes to zero every time it’s tried.

If the inflation rate is 25%, it means that your $100 will be worth $80 in the next year.

For those of you who are not good at math, think of it like this:

Something that costs $100 will cost $125 a year later if the inflation rate is 25%.

If you can buy 1 liter of milk for $1 this year, you’ll need $1.25 to buy the same 1 liter of milk next year.

If you kept the dollar in the bank, next year it’ll still be $1. You’ll only be able to buy 800 ml of milk as the price of milk is now $1.25/liter.

Your $1 has declined in purchasing power by 20%. It can buy 20% less stuff that it could last year as prices have gone up by 25%.

As you can see, in an inflationary environment – it is foolish to have lots of cash in the bank.

You are losing money every day to inflation.

It is better to invest the money in either starting a business (see #8) or into the crypto or stock markets (see #9).

P.S. It’s good to have cash in the bank in anticipation of a recession. You get to buy assets at dirt cheap rates after a crash. Once markets have already collapsed, cash is a sinking ship.

4. Cut Your Living Expenses

Things are going to get worse before they get better.

If you haven’t already, you need to cut costs and reduce your living expenses.

Living cheaply has two major benefits.

First, it reduces the chances that you’ll need to go in debt to make payments for necessities.

As prices rise, more and more households have to go in debt to pay for necessities like rent, energy, and food. This is happening to more and more people every day. Credit card debt and BNPL (buy now pay later) are skyrocketing.

Second, living cheap makes more money available for your business or for investments.

Prepare for a Recession: Quick tips to cut expenses massively

- Move: Rent is the biggest expense for most people. If you’re working from home, you don’t need to live in an expensive city or an expensive part of the city. Move to a cheaper part of your country, or move to a cheaper part of the world like India or SEA, or move to a tax haven.

- WFH: If you’re not working from home, start working from home. Negotiate with your current employer or apply for remote positions. You not only save money but also a ton of commute time (See #9).

- Cut bullshit subscriptions and things you don’t need: Cable, Netflix, Hulu, whatever – get rid of it. Once again, not only do you save money but also time.

- Learn to cook and don’t eat out (except to socialize): Again, saves you money and your health improves. Make your own tea/coffee.

- Stock up on consumables: Bulk buy whey protein, toothpaste, coffee, and other consumables. As prices rise (and packet quantities shrink), buying in bulk now is to getting a discount in the future. You would have eventually bought these items anyway.

In a recession, it’s a big let up to have low costs and no commitments.

Once again, living cheap ensures that you 1) don’t have to go in debt to pay for things you need 2) makes money available for business and investments, and 3) makes the downturn much less stressful.

5. Make Yourself Unfireable From Your Job

If your primary source of cash flow is a job, it’s of paramount importance that you become an unfireable employee.

Like the name suggests, an unfireable employee is one the company wouldn’t even dream of firing.

There are only three ways of making this happen:

A) Be an extremely profitable employee

The company makes so much money because of you that it would be incredibly stupid to fire you.

If you’re paid $150k but you make your company $500k in profit, they will not fire you, no matter how bad the economy is. The bonus may not be as good, but you’re not on the chopping board.

Work hard and don’t be one of those liability type employees who add little value. Make the company lots of money and there will always be a place for you.

A paragraph from a book I read a few years ago that drives this point home. Of course, it’s better to be liked than to be loathed. This is from The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron (India, USA).

B) Do something that no one else can do

Be too useful to be fired.

This means doing stuff no one else can do or very few people know how to do.

Say, the place you work at has a complex computer network system. You maintain the IT systems along with your regular job role. They will not lay you off because if they let you go, and the network goes down, they won’t know what to do.

If you’re a COBOL programmer, you will not be out of a job.

(For the uninitiated, COBOL powers the back-end of the banking industry. It’s painful to find people who can program using COBOL because it’s an ancient technology. Young people aren’t interested in learning COBOL. The average COBOL programmer is about 60 years old).

You get the point.

Make yourself indispensable at your work.

If you can do something that no one else can do, you won’t be the one scared about getting laid off. Your employer will be scared of you quitting.

C) Be so entrenched in the system that it’s too painful or risky to remove you

This is a risky strategy, but if you have nothing else, it’ll have to do.

Here you play the political game to the extreme. You try to be well liked by the right people. You suck up, flatter, and feed their insecurities.

You hope that when the time comes, you are spared because you are liked by the right people.

You can get extra insurance by becoming the main point of contact for a few high-value clients. No company wants to risk creating friction with important clients.

In any case, if a job is your main source of cash flow – you can’t afford to be out of one. Do what you can to keep it.

Prepare for a recession: Keep Your Resume Up To Date

Keep your resume up to date and apply for new jobs from time to time. Brush up on your interview skills and go for some interviews.

Just in case you end up out of a job, you want to minimize the downtime.

There’s also an off chance that you might find something better. It doesn’t hurt to try.

If you find a new and better job, you can rest assured that they won’t lay you off anytime soon. No one goes through the pain and costs of finding and hiring a new employee only to fire them 6 months later.

6. Start an Internet Based Business

This is the most important section in the entire article.

No job will ever make you rich. At best, you’ll be well off.

If you want to be rich, you need to start a scalable business, and preferably online.

Many moons ago, I wrote a technical guide on making money online, so start there.

If you’re willing to trade time for money… (more money and fast, but not as much in the long run):

If you are a complete newbie with no skills, here is how you can start making your first money online:

- Pick any high-value high-demand skill and learn it (Skillshare is a great place for this. I’ve done a lot of courses from them and use it to upskill all my employees.). Look for courses on web design, copywriting, logo animation, programming, video editing, etc.

- Sell it as a freelancer. Use social media (DM people), cold emails, and gig sites like Fiverr to get clients.

Granted, it’s not an ideal long-term setup as you’re still trading time for money. It’s still a great way to get started and make your first internet dollars. Don’t let the great be the enemy of the good.

If you already have a skill, you both freelance and produce courses for others who want to learn your skills.

Once you get your foot in the door, you can figure out how to do it without making it a time for money exchange.

If you’re unwilling to trade time for money… (less money in the first few years but scales up):

If you’re like me and don’t want to trade time for money – blogging, social media, and SaaS are great businesses. You can make a lot of money with them.

My friend Jon Anthony from Masculine Development makes about $50k a month from his blog. He has a course teaching SEO and blogging. If you’re interested in starting a blog as a full-time business, get his course.

If you want to start a Twitter based business, check out my guide The Art of Twitter.

Unlike blogging, Twitter doesn’t need too much time. Writing tweets is much faster and easier than writing articles. It takes about 2 hours a day and most people just do it at work.

Social media is also fast. Most people using TAOT see money coming in 2-3 months. SEO is very stable but takes time to pay off (think in years, not months).

Depending on your goals and situation, you need to keep these things in mind when picking a business.

This is a great era to be alive in and there are literally unlimited ways to make money and build a business.

- SaaS

- Blogging

- YouTube

- Podcasting

- Freelancing

- Social media

- Amazon KDP

- Video editing

- Graphic design

- Web development

- Affiliate marketing

- Print on Demand (PoD)

- Direct response copywriting

- SEO and site-speed optimization

- Selling a service (like a gym trainer)

- This list is endless. So much opportunity.

You can literally do these from your home with negligible upfront costs. Maybe $100 for a website and up to a few hundred dollars in a course from someone who’s done it before and you’re good to go.

Compare this to 30 years ago when you’d need to shell out at least $100k to lease a shop and buy the inventory. Greatest time to be alive.

You can also try your hand at physical product e-commerce. I’ve never done it before so I can’t recommend you a resource for this, but it should be trivial to find them.

Recessions are a great time to start a business

(Also, the most important thing you need to do to prepare for a recession.)

Start a business and get done with the initial gestation period in the recession itself. You will then ride the entire bull run that comes after it.

That is the opportunity.

Your business will make 3x, 5x, and even 10x what it makes in a recession once prosperity has returned.

Read that again. And again. And again. Till you get it.

You will get stinking rich if you can set up your businesses in the recession itself.

When the bull run happens again, you will be like a duck in a flooding lake. You will start from the top and keep going up effortlessly with the water.

Most people will be down under and will not benefit as much. You’ll end up so far ahead that it’ll be impossible for them to catch up to you.

This is why the next 2 years are an enormous opportunity. If you don’t make use of it, you’re going to end up far behind.

This is also why it’s extremely important that you start yesterday and waste no time.

How to Find a Business Idea

Finding a business idea is actually not that hard.

All you have to do is look for something where there is demand but not good solutions. Create the good solution, charge for it, and you have your business.

For example, there was no one on the internet teaching how bitcoin actually works in a structured way.

I moved fast, assembled a team, and created Teach Yourself Crypto, the #1 crypto course on the internet.

We created a system where people can pay to give an exam and get a verified certificate to put on their resume. We make a small amount of money and their employability increases instantly.

The system went live about 2 months ago and we’ve already sold hundred of certificates.

Another example, I always felt there were few good self-improvement resource for men. Most stuff is fluff and targets women (you go girl) and I thought men were an under-served market. So I created LifeMathMoney – and here we are.

There are business opportunities everywhere.

Will people start billion dollar companies in the future? Yes.

Will people start hundred million dollar companies in the future? Yes.

Will people start ten million dollar companies in the future? Also, yes.

If all the good business ideas were taken, this would not be possible.

With the internet, there are business opportunities literally everywhere. They are so numerous that you are tripping on them.

Especially in content creation. Every day you do a YouTube or Google search, you stumble upon them.

The next time you’re looking for something on the net but can’t find it – consider making it.

You may not make ten million dollars from it, but it’s a start.

Losers will be losers.

People who say “I want to start a business but I have no ideas” and years go by as they “wait for an idea to come” are losers.

These people lack what it takes (initiative and drive) and they don’t want to do any work.

They don’t want to do any research, learn new skills, and take the risk of getting rejected and failing.

“I need an idea” is their way of rationalizing their lack of action. They don’t have to put in the work, get to avoid the risk and embarrassment of failure, and get to keep their ego.

They’re losers but they want to feel like winners. “I can’t start because I don’t have an idea” is something they say to make themselves feel better. Copium and hopium.

If you gave them a perfect business idea and a perfect execution plan, they’d still find a reason why they can’t do it.

You can’t save everyone, and losers will be losers. These people deserve to be poor and there’s nothing you can do to change that.

7. Invest in Crypto or Equity (Buy Blue Chip and With a Schedule)

If you have money left after you invest in your business, invest it. You can put it in crypto or equities depending on your risk tolerance.

(I don’t recommend real estate. Maintenance costs and property taxes are a burden and RE is very illiquid.)

You will not become rich buying stocks or crypto with your measly $50-100k. (Most traders lose money.)

Most people who trade stocks lose money. Even if your $50k investment in crypto went 10x – it’s still only $500k. Although not nothing, it is still not fuck-you money by any means.

A scalable business is what will make you rich. The money you invest in your business is by far the highest returning investment out there.

If you have excess cash left over after you put what you can in your business, then invest it in the markets.

If you’re afraid of market volatility, stick to a diversified portfolio of equities.

If you can take on high risk and believe the vision (the future of money is crypto), the crypto markets are for you. Bitcoin is the lowest risk cryptocurrency in this category, followed by Ethereum.

If you have no idea where to start with crypto, you can have a look at my crypto portfolio (meant for rich people only).

Invest on a schedule (I recommend dollar cost averaging every month).

Invest in blue chip stuff that will stand the test of time. You don’t want to buy garbage that will go bankrupt and go to zero.

Blue chip things may go -90% in price, but as long as the business and fundamentals are still around, it’ll be back up again.

If the business and fundamentals are bad, the company goes under and there is no hope for recovery.

Side Note on Human Nature

P.S. As a side-note to the invest-in-your-business-first thing:

I’ve always found it funny that it’s so easy to convince people to invest in the markets (i.e. other people’s businesses). It’s much harder to convince them to invest in their own businesses.

People will spend $100k+ on a business degree taught by some professor who’s never done it himself.

They’ll hesitate to spend $500 on a course by an expert who has verifiably done the exact thing he’s teaching.

People will spend $200 on a date with some chick from Tinder but think a $100 book is expensive.

Like I said earlier, losers will be losers.

That said, human behavior is very interesting like this.

If you can figure this human behavior stuff out to a formula and exploit it, you’ll make an absolute killing in sales.

You will literally become an infomercial or affiliate marketing billionaire.

Alex Hormozi’s book $100m Offers (India, USA) is a great attempt at decoding what gets people to buy. Although, we’re still a long way from distilling human nature down to a mathematical formula.

8. Hold Debt (It’ll Become Worthless)

If you have debt and the interest rate is below the inflation rate, keep it around as long as you can.

Don’t pay it off beyond the minimum payment even if you have the money.

Government subsidized student loans, zero interest EMI, etc. – keep it around.

Inflation is going to make this debt be worth less and less as time passes.

The longer you take to pay, the less you actually end up paying in real purchasing power terms.

If you can “buy now, pay later” at 0% interest, do it (many businesses offer this).

Any payment you make later costs you less than any payment you make today. This is just how inflation works.

P.S. Just make sure that you don’t buy extra stuff because you are buying now, paying later. That’s the catch! Human nature! That’s why these facilities exist at 0% interest.

They make money off the human tendency to spend more when they don’t feel the pain of paying upfront. Be aware of this and you’ll be fine.

9. If you’re doing well, don’t show it.

Like my friends at BowTiedBull say, don’t flex.

Seriously, don’t do dumb shit like wearing a Rolex on the street.

This is an economy where the average household is going in debt to pay for groceries.

Flexing money is attracting bad karma towards yourself.

Woooo, that was a long piece! Don’t say Brother Harsh doesn’t deliver!

I hope you found it useful.

With love,

Harsh Strongman

P.S. If you liked this piece, also subscribe to my YouTube channel. I guarantee that you’ll get a lot from my YouTube channel too.

![Traits Women Find Attractive Traits Women Find Attractive (And How to Score Yourself) [PART 1: Physical Aspects]](https://lifemathmoney.b-cdn.net/wp-content/uploads/2025/11/Traits-Women-Find-Attractive-1.jpg)