Financial freedom or financial independence is when you’ve got enough money that you can live the type of life you want without having to work actively.

I don’t mean things like “live the minimalist life clipping coupons”, I mean live a rich lifestyle that you want to live.

How Much Money Do You Need to be Financially Independent?

The actual number depends on how you live, where you live, etc. but here is a simple way to calculate it.

Step 1: Estimate Your Annual Costs of Living The Life You Want to Live

Step 0 is figuring out the kind of life you want to live.

Is it in a busy city or a tourist town or somewhere else? Are you the type of person who spends a lot of money or do you prefer to live a spartan life? These are things you have to think through and decide for yourself.

Personally I’m not much of a minimalist and I like to spend money to buy quality products and useful stuff. If you’re one of those frugal types, your expenses will be lower.

Once you’ve done that, fill up this sheet and calculate how much it costs for you to live the life you want.

| Expense Type | Estimated annual costs |

| Housing (Rent + 10% for maintenance) | |

| Food and household consumables | |

| Utilities: Electricity, Phone, Internet, etc. | |

| Local travel – Taxi, Car depreciation, Diesel, etc. | |

| Clothing | |

| Fun money, electronic gadgets, etc. | |

| Vacations / travel | |

| Other miscellaneous costs (~20% of total cost) | |

| Total: |

Step 2: Multiply That Number by 25

Basically the Rule of 25.

You need 25 years worth of your expenses to call yourself “financially independent”.

This means if your annual expenses are $40,000, you need to have $1M in the bank to be financially independent.

Spending $100k a year? You need $2.5M to call yourself financially independent.

I would say the vast majority of people need somewhere between $1M and $5M to be financially independent – the lower end if you live in a cheaper country and the higher end if you live in a more developed country (They represent annual costs of $40k and $200k).

Once you have 25x your annual expenses invested, you can safely withdraw 4% of it each year (the market returns more than that on average so your investment value should not reduce in the long run).

How Many Years Does it Take To Save Enough To Become Financially Independent

It depends on how much money you save and invest per year.

The math is simple:

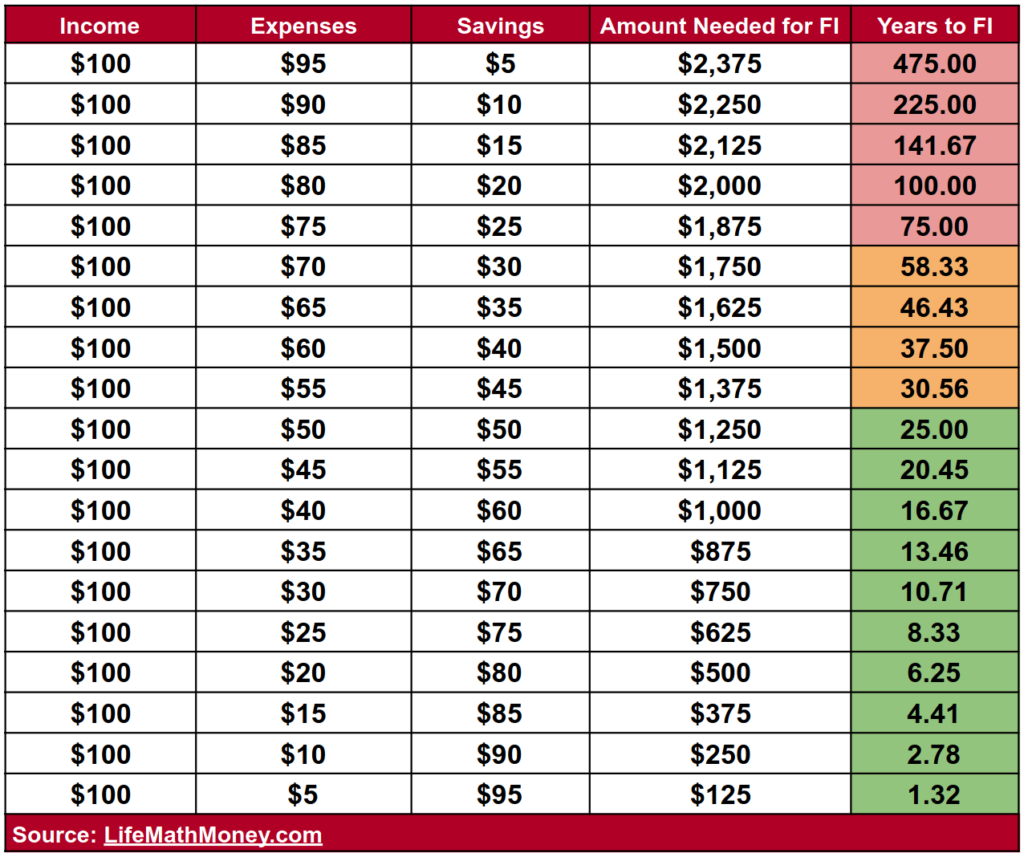

Time to FI = (Annual expenses * 25) / Annual Savings

If you are happy with your current lifestyle and your income stays constant (in real terms i.e. after accounting for inflation), then see the chart below:

If you save half your income each year, it’ll take you 25 years to become financially independent.

If you save 30% or less, you’re not getting anywhere.

NO ONE, and by that I mean NO ONE, is getting anywhere “saving 10%” like the common advice asks them to. The MATH does not work.

That’s the ugly truth about money. You don’t get anywhere unless you’re saving a BIG percent of your income.

How to save a big percentage of your income?

You have two options:

Option 1: You become a frugal weirdo who tries to save every last cent and lives a life of poverty. If you want to make it sound posh, you can call it “minimalism” – but really you’re just a loser living a poor quality life.

Option 2: You find a way to make more money so despite spending to your heart’s content, you still save a bunch of money.

Personally I’m not a big fan of option 1 and I tend to look down on miserly people. Life’s far too short to live a miserly life and quite frankly… why not do something that lets you live better?

As far as I am concerned, Option 2 is much better.

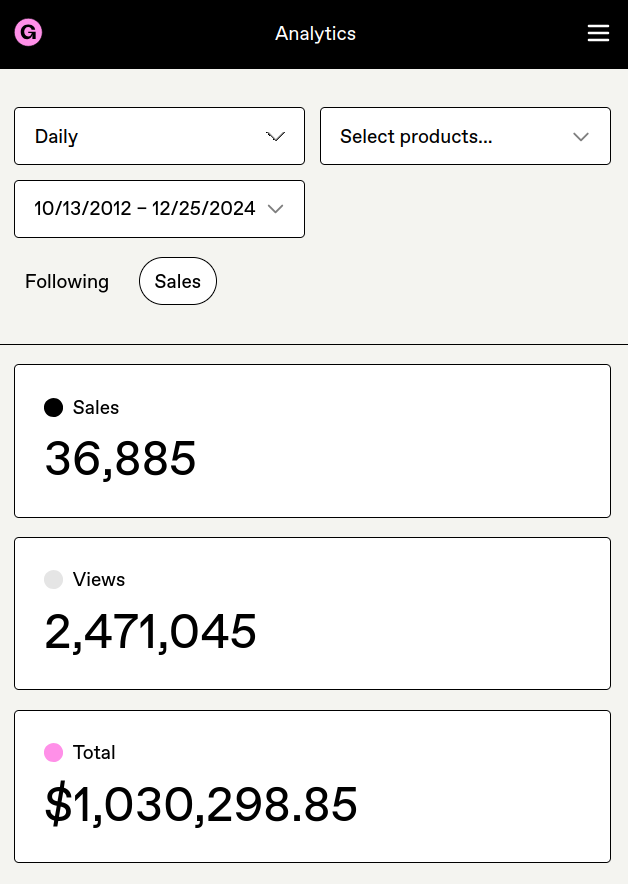

I end up saving 90%+ of my income simply because I built businesses that give me high income. I don’t try to save money on little things like coffee.

This doesn’t mean that I waste money, it just means I don’t need to stress about dropping $200 on a nice dinner with the wife a few times a week.

If you want to become financially independent, do it by making more money, not by becoming a frugal weirdo.

Besides there’s a clear hard floor on how much you can cut expenses (can’t go below zero) but no ceiling to how much you can make. You can get filthy rich in less than 10 years.

If you make $100k – what would you rather do? Find a way to live on $40k clipping coupons or increase your income to $300k so you can live how you live while still having money to invest?

Note: You still need to avoid lifestyle inflation otherwise you’re back at square 1.

How to Increase Your Income

If you’re a long term reader, you already know the answer and have already made your first million from the internet. If not – keep reading.

The answer to making more money is to make it from the internet a.k.a. WiFi Money.

Dead broke? Just download a copy of No-BS WiFi Money (FREE) and get to work.

Got some cash? Pick any high paying skill like audience building, web design, copywriting, or programming, and start selling it online.

You NEED to do it via the internet because internet based businesses are SCALABLE.

If you don’t want to do any business that I suggested above – then think of something else and do that. Come up with something new (like a SaaS product) or do something that works for most people (selling high paying skills).

You can also start a physical business but that’s much more expensive, much less profitable, and much more of a hassle. That said, it doesn’t hurt to make some extra cash from things like Airbnb if you have the extra space.

Stop making it over complicated and pick any course/guide (it needs to be made by someone who’s done it before) and just execute the business plan. Most of you can make your first $1 online in 6 months if you actually put in some effort.

The only thing you want to avoid is buying courses/guides from people who haven’t done it before because their way of making money is by selling you the course – examples include your college professors.

If someone has real experience (i.e. they make money from doing it), their advice and experience is worth buying.

Why Most People Never Become Financially Independent

The reason why most people do not become financially independent or get anywhere with money is that 1) they have a bad model of money that doesn’t work in real life and 2) laziness.

Bad Money Mental Models

Most people think they will eventually become rich if they only save 10-20% of income but that doesn’t actually work. They haven’t done the math themselves. They just “think” they’ll get there.

Don’t get me wrong, saving 20% of your income is a good way to create an emergency rainy-day fund but you will never become financially free doing it.

The math doesn’t work. If you only save 20%, it takes 4 years to save 1 year worth of expenses. It will take you 100 years to save 25 years worth of expenses i.e. it’s not possible.

Most people don’t think in math terms and just assume “things will eventually work out”.

You cannot become financially free unless you’re saving a big chunk of your income, and the only way to do that is by making a lot of money (I do not consider living on nearly poverty line expenses also known as Lean FIRE to be a real option).

Laziness

The other reason people never become financially independent is pure laziness.

Many smart people have already figured out that they will never become financially independent working a job (at least not before old age) and that they need to start some kind of business if they ever hope to get there.

The problem is “someday”. These guys are always stuck in “someday” and never take any action TODAY.

Someday and tomorrow are just words people use to express their laziness. Weeks, months, and years go by and these types never take any action.

Starting an online business is NOT hard but it does take some effort.

You have to learn a high paying skill (I recommend audience building, web design, copywriting, or programming). You have to send cold emails and DMs. You have to do the work.

It’s easy – all you have to do is click mouse buttons and hit keys on the keyboard.

But most people are lazy. They just don’t have the initiative to do it. They’d rather just beg their boss for leaves instead of trying to become their own boss.

There’s no excuse. The internet gives equal opportunity to everyone, but not equal results. Meritocracy.

If you don’t do the work, you don’t get results. And I have zero sympathy for the lazy.

Why Mainstream Money Advice is WRONG

Mainstream money advice i.e. “save 10% of your income” is WRONG. The math does not work.

Do the math for yourself:

If you continue working a job, add up how much total you can expect to make in the next 25 years. Then deduct your number for 25 years worth of expenses. That’s how much you’ll save after 25 years of work.

Unless you’re a CXO level person at a large listed company, you will not have enough money to even last you 10 extra years. The math simply does not work.

I know this because I own a tax consulting firm. You cannot become financially independent from working a job.

It only works for people at very high corporate levels and by the time you get there, you’re already old. Who cares how much money you have when you’re 60 and don’t have the health (stamina/knees/strength) to actually enjoy it to its fullest?

The only way to become rich or financially independent in a reasonable time-frame is by starting your own business. There’s no other way for most people. Ask anyone who tells you otherwise to show you the math. Hint: They can’t.

Hope this helps.

Your man,

Harsh Strongman

![Traits Women Find Attractive Traits Women Find Attractive (And How to Score Yourself) [PART 1: Physical Aspects]](https://lifemathmoney.b-cdn.net/wp-content/uploads/2025/11/Traits-Women-Find-Attractive-1.jpg)