Wall Street Playboys was one of my favorite blogs that I followed all the way from 2014 to 2021, when it was shut down (Wall Street Playboys Archive is now available). It was run by real Wall Street professionals who came from nothing (they had to live in a car for a while!) and provided real, actionable advice on a variety of topics like personal finance, affiliate marketing, investing, etc.

The authors of WallStPlayboys have rebranded to BowTiedBull, and are producing educational content on cryptocurrencies and DeFi through their Substack newsletter, which I strongly recommend subscribing to (I’ve been a paid member since the day it was launched, I’ve gifted paid memberships to 10 other people).

Needless to say, WSP was one of the blogs that inspired me to create LMM. I got in touch with the authors and asked to interview them. You can read the full interview here (or listen to the text-to-speech version using the player below):

1. I’m a long time reader of BowTiedBull (been reading you since 2014 when you used to go by WallStreetPlayboys), and your work has left a strong impression on me after almost a decade of reading. For the people who do not know you, can you tell us a bit about your background and how you got into writing?

The truth is that the idea spawned initially as a joke when out partying in 2012 (long-story to be revealed later). The old name was chosen on purpose to invoke emotion. Our writing style isn’t “fun” since it is direct and to the point. We learned quickly that writing this way filters for people who are much smarter than average which creates a readership base that is wealthy/well-off. Writing is a lot more fun when you know your message is going to people who will eventually become winners.

Originally, it was just for fun until we realized the writing could create some positive changes for the younger generation. For example, college does not prepare people for the real world. And. We started writing about how life actually works. Getting a 4.0 GPA at a top university doesn’t mean anything as you’re simply memorizing and following rules. The real trick to the corporate world is likability and doing the minimum to be seen as a “top performer”. After that you can spend your free time focusing on what matters: building equity in your own business.

Since then we have written about a ton of topics. We started with investment banking and gave away everything: correct resume format, interview answers etc. Anyone could follow the website and break into the industry without spending hundreds of dollars on a course. Our background is technology investment banking. With this background we went into affiliate marketing which requires the use of a lot of technology tools (VPNs, software, Virtual Servers, etc.).

In short, we’ve been writing for about a decade and a lot of this was honestly a bunch of luck. Technology investment banking (Wall Street), then forced to use and learn complex software… then learn about crypto which is a software designed to disinter-mediate the financial industry. Right place right time. This is not meant to be a “brag” but rather a strange feeling of pure luck. The applications being built on crypto are quite literally copy paste jobs of wall street products (just with code and no middlemen!).

2. I see that you went from producing content for Wall Street professionals to making educational content on cryptocurrencies and decentralized finance. What got you interested in crypto and what role do you think they will play in the future?

Long-story short, in 2012-2014 people involved in technology in some way shape or form heard about Bitcoin. In 2014 there was a shady exchange called Mt Gox that crashed and ~650,000 coins were “lost/stolen” (Tens of billions of US Token value today). This was the biggest scare in crypto that we’ve seen so far as the protocol was small at the time (small enough to shut down). Fast forward seven years and we know how it ends, the network somehow survived and the protocol became more decentralized.

If you go back and watch interviews on the topic, you’ll find that the tech guys all say the same thing “There was a calm” after this passed. What they are really saying here is this: “They couldn’t stop it”. 2017-2018 was a fun ride with a ton of speculation. The crash was by far the largest blessing in modern history as it allowed people to accumulate a large position if they wanted. We doubt something that big ever happens again. (IE. prices may go down 50% but $4,800 US Token per coin vs. $20,000+ is not in the same ball park particularly for your typical middle or upper middle class family).

Now for the fun big picture: governments need to compete for citizens. There was a book on this topic called “The Sovereign Individual”. We’d go as far as to say that this is required reading for anyone at this point. This era relates to the novel 1984, the millennial and zoomer generation will relate more to the Sovereign individual.

This means that *you* (everyone reading this) will become your own bank. This means you will be allowed to lend out your assets. You can borrow from anyone in the world and on top of this you can transact 24/7/365. If you’ve made a wire transfer before you know that there are windows to send money even if it is a small sum. The future is 24/7/365 with no intermediary.

Crypto currency is the biggest invention we’ve seen since the Internet. Sadly, we’re getting old here and many people don’t remember life before the internet. We used to put quarters into payphone machines to make domestic and international calls. Back then people argued that the internet would be less impactful than the fax machine… These arguments all proved to be incorrect.

3. We keep hearing about Decentralized Finance. What is DeFi? How does it compare to the traditional financial system?

Ah yes the future is here. If you understand the big picture above, DeFi is the death blow to middlemen. This is not limited to sending and receiving money (Bitcoin). Anything with a financial contract can now be put online.

Bitcoin in a sentence. This is digital money where the only thing you can do is send and receive it.

DeFi in a sentence. All Wall Street functions are being replaced by code.

Take a loan for example. Before you had to go to a bank and get the loan. Now you can get a loan by making Bitcoin a productive asset. If you have $100,000 in Bitcoin and need $20,000, you can borrow $20,000 and let the software system hold onto the coins until you pay them back (at an agreed upon interest rate). After you pay back the loan, you get your coins back. If you don’t pay your loan back, the person who lent you the $20,000 eventually gains the rights to your coins (if you default). All of this is run by software not a bank/middleman.

Hopefully the above is clear. DeFi and crypto is causing generational disruption. You no longer need the bank. While many say “I don’t have time for this” we have some bad news. You’re saying “I don’t need to learn how to use a computer or the internet”. Eventually, you have to learn.

4. I’m told most DeFi protocols are centralized on some level or the other. Do you see them becoming truly decentralized in the future? And what will happen to the existing banking system? Is this the final chapter for Wall Street?

Centralization is a funny concept because when any crypto currency is created it actually starts out as centralized. Even Bitcoin started out as a centralized currency. You had a few guys running the bitcoin software on their computers and that was about it. Over time, more computers came onto the network so now it is quite decentralized.

With DeFi you have a few extra issues to deal with. First you have the governance of the token. If the majority is held by a small number of people you can argue that it is centralized. Second, you have the stable coin issue where most stable coins are backed by centralized coins such as USDC. Third, you’ve got VCs and other major firms attempting to take the majority of the stake so that they can control the future of the protocol. For the third one you can look at a Bitclout as a good example, guys like Chamath and other VC investors were in at $5-10 (check the blockchain) so they own a huge chunk of the centralized coin. (Note this may change, but as you can imagine, an unfair launch like this does not get much love from the crypto community)

Over the long-term? Yes, it will eventually work. You can see the writing on the wall based on the volumes. If you look at decentralized exchanges, they are slowly doing more and more volume than massive centralized exchanges like Coinbase. It has only been a couple of years.

The existing system is going to look a lot like regular physical mail. It will be around for a long time but no one will really use it. Over the long-term we expect it to look like this:

- Small countries adopt crypto – such as El Salvador

- Countries with the most to lose like China or the USA will try to ban it

- As adoption ramps up, other countries will adopt it

- As countries adopt it payment processors adopt it

- As this continues price goes up

- More attempts at regulation, and

- Go back to step one.

In the end, when you have a technology that is faster, more secure and more reliable that product wins.

If a major nation is smart, they would actually adopt it first and gather as much as they could. If they bought an incredible amount (say 10-20% of the entire ETH and BTC supply), then announced that it is being used as a reserve currency, the value would sky rocket. It wouldn’t matter for the particular nation that does this as they would already own it.

You’re seeing this realization by public companies slowly but surely. Said another way… If Google purchased BTC on its balance sheet would the price of BTC in USD terms go up or down? We think everyone knows the answer. So it’s a bit of a waiting game at this point. Just a lot of regulatory headaches and people understand the technology.

To keep things honest here, the one part of Wall Street that will be around is M&A/Advisory. You can’t put relationships onto the blockchain. If someone is going into investment banking we’d advise them to shoot for Allen and Company, Lazard, Qatalyst Partners, Evercore, and other firms with *limited* equity or debt offering business lines. While it may sound cool to work for a bulge bracket like Citigroup, that is a major bank with other business lines in massive decline. You’re better off going to a pure M&A shop. If you’re going to go into fund raising like ECM or DCM, you learn a lot less and that industry is going to see significant pressure.

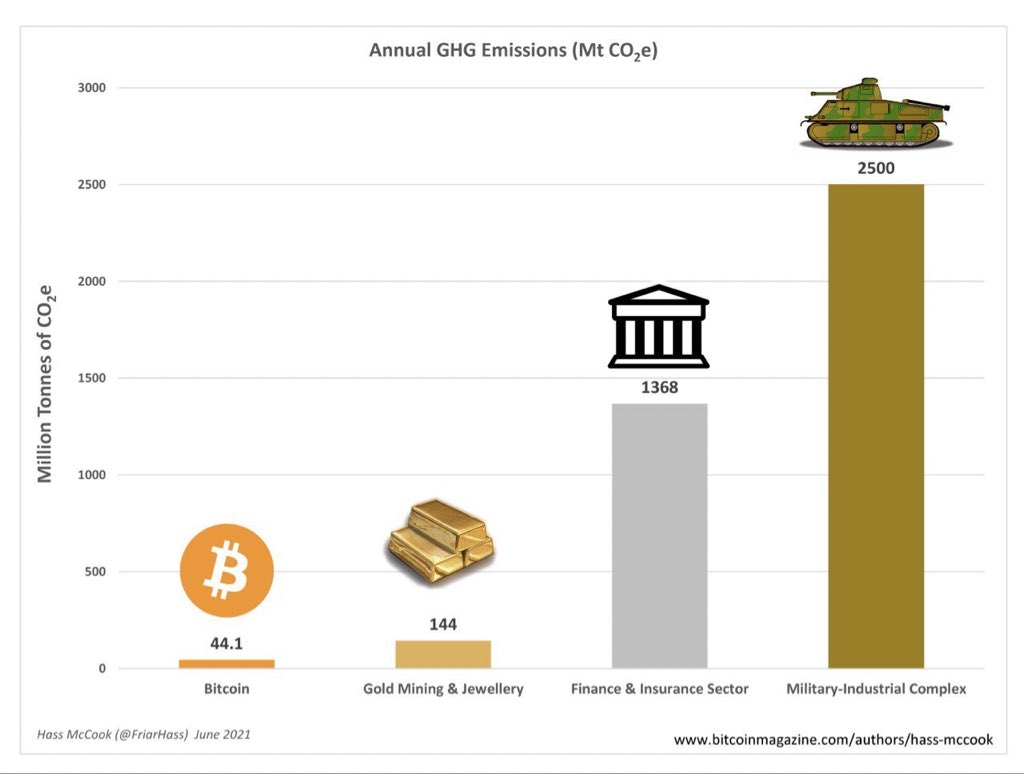

5. There has been much talk about Bitcoin consuming a lot of electricity. What are your thoughts on this?

This is a meaningless argument from a math perspective (no emotions or opinions). Bitcoin and Crypto Currencies are displacing the traditional financial system which means all of the overhead as well. A bank consumes thousands of times more energy. Some simple examples include:

- ATM electrical use when not being used,

- All the computers, air conditioning, lighting, servers, in every single office building around the world – ungodly amount of square footage,

- The creation of physical money which burns oil, trees, metals etc,

- The transportation of physical money, and

- All of the energy wasted securing all of the money – vaults, complex data centers etc.

If we want to look at Bitcoin specifically, around 75% of the mining is already done with renewable resources. Ethereum will be moving to Proof-of-Stake which will not require a Graphics Processing Unit (GPU) to secure the Blockchain and new computer chips are made every year that are more energy efficient. Crypto is the most environmentally friendly means of making payments in human history by a wide margin.

6. I see governments solving all sorts of problems afflicting us today like viral pandemics by printing a lot of money. What will happen to governments in a world where crypto has replaced fiat money (and governments don’t have printing power)? I also see that a large portion of the population lacks IQ/capability and depends on government handouts for survival. What happens to these people if the government is no longer able to provide for them? Are we looking at high taxation and violent revolutions in the future?

Wow that’s a handful! Before answering we should reset the table a bit:

- Crypto allows people to be their own banks,

- Governments need to incentivize the right citizens to move to their country and

- We can agree that a large amount of people are not going to understand the changes.

The current logical conclusion is the use of UBI. Instead of printing money we’re going to have to prepare for a deflationary type system. We’re not going to wake up tomorrow and suddenly have no nations. Instead, a logical move is to offer UBI in the form of food/cheaper shelter and water. Printing money doesn’t solve anything, (we learned that in 2008-2009) all it does is increase wealth inequality. The recent inflation data is quite scary to us. We’re accused of pushing a narrative but 5% inflation is a big deal if you’re living paycheck to paycheck while wealthy individuals see their stock holdings go up 30%.

We’re in inning one of the transition to decentralization. There is still a lot of time for adjustment, so if you look at our prior paragraph, you can get some ideas to help make a smoother transition. The countries/companies that adopt decentralization will benefit and those that fight against it will suffer (along with their citizens).

We have no idea how the next 100 years plays out, no one does. Instead of trying to predict everything here are some clear solutions:

- Switch to a consumption tax. A $250K home and a $5M home should not have the same tax rate. A $250,000 Lambo should have a tax rate that is *much* higher than the tax on a $7,000 used honda civic. This one is honestly mind boggling. The tax rate on a luxury good should be higher than basic living expense items but they aren’t in the USA. If they raise the tax they actually make the item more luxurious/rare,

- Increase employment incentives. Right now technology allows you to do more and more with a single person so you need to incentivize hiring,

- Offer a new education system – the idea of spending 4 years in college where you only use 3-4 classes for your entire adult life is a waste of human and government resources and

- Change the inheritance system so that billionaires or 9 digit millionaires are forced to at least giveaway part of their wealth – handing all of it to two or three boys/girls is just absurd as they didn’t help create anything – their parents did. By “giveaway” we mean something productive – buy farm land, produce chickens/vegetables/fruit… Not a $1B museum with art pieces in it (doesn’t create enough jobs).

Of those only #4 comes off as anti-capitalistic but you don’t want to see a world where taxes are through the roof and revolutions are popping up in countries across the globe (look at Argentina, Venezuela, etc.).

7. I’ve heard parallels between the early days of the internet and the present days of crypto. The internet changed the world in 25 years. Do you think the world will be radically different by that time frame?

Yes. The world is already radically different and we’ll see this initial impact over the next 12-18 months. We think the next 5-10 years is the big change period. Scaling solutions and privacy solutions are advancing at rates we’ve never seen before as it relates to crypto (ZK-snarks, rollups, arbitrum, various layer two solutions, etc.).

How about we answer this a bit differently and start with “what does the next 5-10 years look like?” It looks a bit like this: shared belief communities. We live in a world where you can work with people and never know their name, age, or location (truly color and race blind). We also live in a world where attention is hard to get so platforms/audiences have a *ton* of value. The answer is clear. Show what you would like your community to look like and let the law of attraction work in your favor. Our side of the internet has a simple motto “Equal Opportunity, Unequal Results”. People who agree with this general framework will gravitate towards our community and its the goal of the community to march down that path (it won’t be easy or done in a couple of months/years).

If someone is young they have to become a creator. You’re better off becoming a creator as an individual because you’re harder to replace and the idea of working for a massive company for 30 years is a relic of the past.

Now the next 11-20 years? You should see a large shift to the online community. There are a pair of books to read on this (they are fictional) Ready Player 1 and Ready Player 2. Ignoring the entertainment side, the economy is effectively online. We all spend more of our time online than we do in the physical realm. This means video games have actual monetary rewards built into the system. It means that the majority of the high paid employment opportunities are in Virtual Reality/Augmented Reality and it means that competition is global.

In 25 years we expect all of the changes to be complete. You will have artificial intelligence and robots doing much of the menial work. Food and housing costs should collapse as no human labor is needed to produce the products. Majority of jobs will be digital based. The future is brighter since that has been the case for the past 2,000+ years and optimists always drive change (not pessimists)

8. Tell us about your newsletter. For the record, I have been a member since day one and I find your articles to be very knowledgeable and I look forward to every email bearing the name BowTiedBull. How did you get into making educational content?

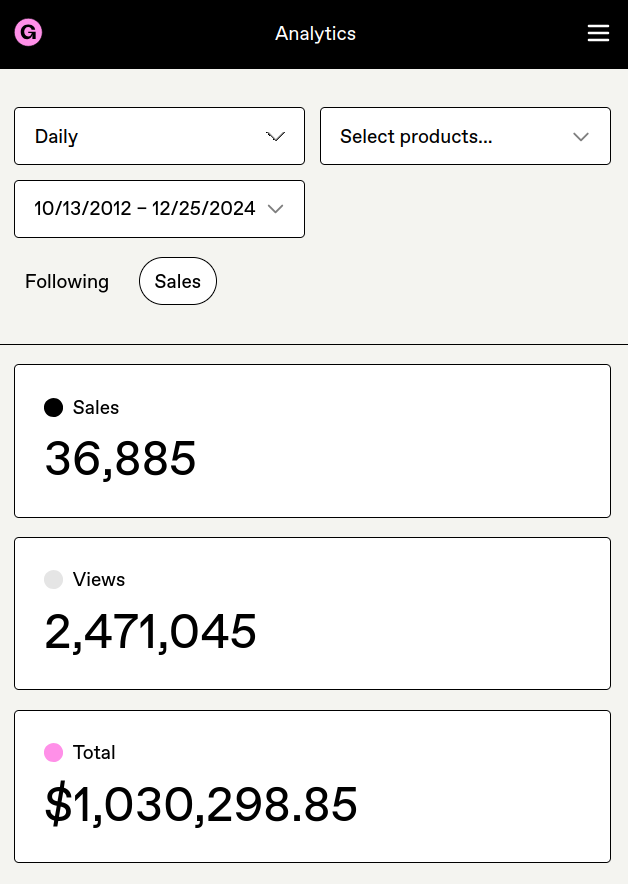

We’re going to run two of them with a team of 8-10 people with either Wall Street or a software background. Both of them will have a free and paid version. BowTiedBull has been around for a decade (if we include the beginning of WallStreetPlayboys) the only difference is that we sold an e-commerce business and now create 25-30+ pages per week. You’re looking at our original content on steroids (effectively a book worth of information per month).

The DeFi substack is going to be run by a mix of software and finance people (and us). It is just too important. This is a biased view but we’ve used DeFi for quite some time now and just can’t see a brighter space within crypto. To us there are really three markets:

- Crypto broadly with layer one technologies like Bitcoin and ETH,

- DeFi protocols such as exchanges and liquidity pools and

- NFTs/layer 2 scaling solutions.

The latter (NFTs) went through a big pricing reset but the use case is clear as they will eventually merge with DeFi in the next 3-5 years.

We looked at the market and the products and realized (again partially pure luck) that the overlap was ideal. Most products being sold were not good or had limited ability to interact and get more information. We’re building out our own scrapers/data base, our own valuation methodology (written and presented like it came from a major investment bank) and allowing any paid subscriber to send in questions so we can answer them as we move along.

BTB Substack in a sentence: high-level macro, portfolio management and analysis. We cover everything from e-commerce to Wall Street to crypto. Majority now is heavily crypto and likely some e-commerce as we have to keep our income streams up as we build out BTB.

DeFi Substack in a sentence: detailed breakdown of all major DeFi products and how to use them. Our goal here is to teach you how to do everything yourself as well. A mind numbing amount of projects pop up every year. The faster you learn DeFi the faster you can make outsized gains by yourself.

Being honest here this is probably the biggest risk we’ve ever taken (at least in the past decade). There is no real second to this one. That said, we couldn’t look in the mirror knowing we didn’t try. If it fails we’ll be okay financially anyway and if it works we’ll leave a small positive mark on society as a whole. Won’t be buried 6 feet under with regrets. We’re already pseudo anon but for this to have a chance we’ll branch out a bit more and help other people start business that benefit crypto/the BTB community as a whole. Help others win and you’ll win by default!

That was a long one! I hope you guys enjoyed the interview and learned a few things from it.

I strongly recommend signing up for the Substack newsletter (there’s a free option too) – it’s one of the best resources on DeFi and Crypto from an investment perspective. I’ve been a member since the day it was launched and I haven’t missed reading a single issue.

Well, let me know your thoughts in the comments below, and any questions in case you have any!