What is Bitcoin?

Bitcoin is a decentralized cryptocurrency founded by an anonymous individual/group who calls themselves Satoshi Nakamoto. It is an upgrade to the currency we currently use (fiat currency from central banks) just like email is an upgrade from postcards.

The Bitcoin protocol is decentralized and hard-capped to 21 million i.e. it is not controlled by a central bank and can’t be constantly devalued by uncontrolled minting that central banks all over the world do.

This article is about how to invest in Bitcoin and not about the concept of what Bitcoin is or why it’s valuable, so if you want to learn about Bitcoin as a technology, take our completely free course on everything Crypto.

How to buy Bitcoin in India

There are two ways you can buy Bitcoin in India: you can either buy from a centralized exchange, or you can buy from a P2P platform. We’ll be discussing both.

Buying Bitcoin from an Exchange

There are many exchanges you can buy from. Some popular ones in India are CoinDCX, WazirX, and ZebPay.

You simply sign up to an exchange, complete your KYC, connect your bank account, and start buying.

This is the easiest way to get some bitcoin and has the least hassle involved.

Which exchange do you recommend?

The Indian exchange I use is CoinDCX. It does the job well and I’d recommend it. (This is not a sponsored post.)

The sign-up is simple and they get you started quickly (although, at the time of writing, all Indian crypto exchanges are facing delays with INR deposits because of what can only be termed as censorship by the banking system).

Buying Bitcoin on CoinDCX

Load some INR into CoinDCX. Once your deposit shows up in your account, you are ready to start buying.

We will use their trade option (not quickbuy) since the prices are cheaper.

Search for and click on the BTC/INR pair.

On the right-hand side of the screen (on desktop), you’ll see the Last Traded Price (LTP) and the bids and asks.

For those of you who don’t know what these terms mean:

Bids: These are the prices at which people have placed orders to buy bitcoin. It’s sorted from highest to lowest. In the image above, the highest bid (i.e. buy order) is at ₹29,48,665.41. The order is for buying 0.05959 bitcoin, so the order value (price * quantity) is ₹1,75,710.38.

Asks: These are the prices at which people have placed orders to sell bitcoin. It’s sorted from lowest to highest. In the image above, the lowest ask (i.e. sell order) is at ₹29,54,940.14. The order is for selling 0.07017 bitcoin, so the order value (price * quantity) is ₹2,07,348.15

Last Traded Price (LTP): Whenever the highest bid (price in the buy order) is higher than the lowest ask (price in the sell order), a trade will be executed. The LTP is the price at which the last trade took place.

Click the “Buy BTC” button and a window like this will show up:

You choose the price you want to buy at and you place your order.

If the buy price you set is higher than (or equal to) the lowest ask price, then your order will be executed immediately (assuming the lowest ask order is selling at least as much bitcoin that your order wants to purchase – otherwise your order will only be partially filled and you will have to wait for more sell orders to come that are below your bid).

If the buy price you set is lower than the lowest ask price, you’ll have to wait until someone places a sell order at a price lower than or equal to your buy price.

Once your order is executed, congratulations, you now have your first bitcoin.

Let’s withdraw it to our own wallet. For that, we first need to set up our own wallet.

Setting up your wallet

We’re going to use Exodus wallet because it’s easy to use and supports many cryptocurrencies. Download it here.

If you’re buying meaningful amounts of crypto, use your desktop and not your smartphone to set the wallet up.

Install it and click create a new wallet. Exodus will give you a 12 word seed phrase (also called mnemonic or backup phrase). Write it down on a piece of paper.

In case you lose your PC or the data becomes corrupted, the software can regenerate your private keys from that seed phrase. In other words, that seed phrase is worth all the money you have in the wallet.

Anyone who gets their hands on your seed can spend your coins. Keep it somewhere safe.

Do not share your seed phrase with anyone.

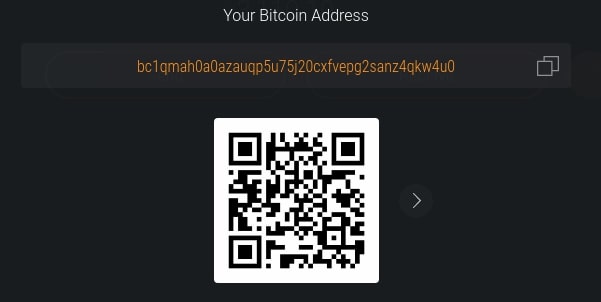

Once your wallet is created and you’ve backed up the seed, you’ll see a list of many cryptocurrencies. Click Bitcoin.

Then click receive and you should see your bitcoin address. You need to share this address with whomever you want to receive payments from.

It looks like this:

bc1qmah0a0azauqp5u75j20cxfvepg2sanz4qkw4u0

This is the LMM bitcoin address. Feel free to send coins here if you’re feeling generous.

If you have trouble creating a wallet or finding your bitcoin address on Exodus, watch a YouTube tutorial. It’s a very simple process, so it’s unlikely that you’ll have any trouble.

Use the newer address format (starts with “bc1”) whenever you can, and only use the older legacy address format (Starts with “1”) when you’re receiving bitcoin from someone who’s using an older wallet that doesn’t support the new format.

(Don’t worry too much about the address formats – they all work and you will get your coins just fine. The reason we want to minimize using the legacy address is because it is longer and thus, takes more space on the blockchain i.e. it makes the transaction fee higher.)

Withdrawing bitcoin from CoinDCX

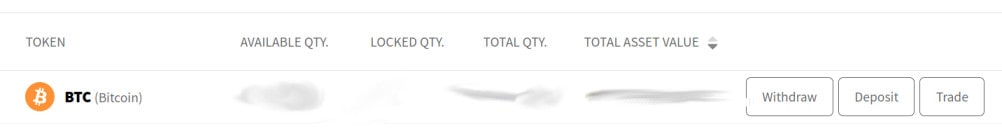

Go to your portfolio page on CoinDCX, where you will see a list of all the coins you own.

Click the “withdraw” button next to Bitcoin.

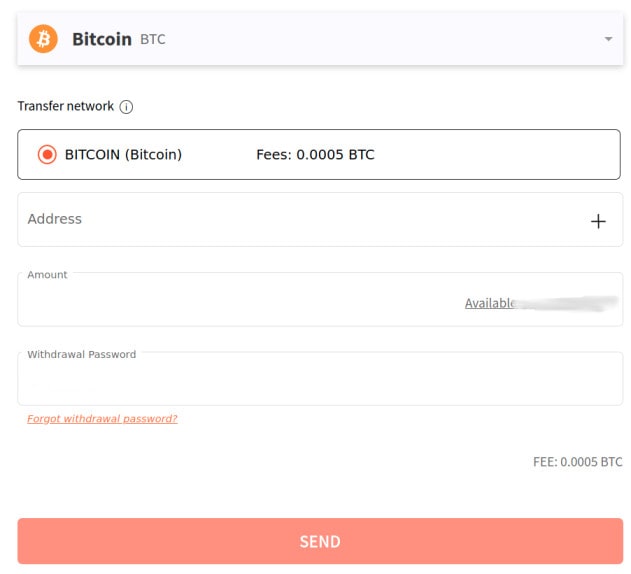

Put in the address from your wallet here, and click send.

The exchange will charge you a very high transaction fee for withdrawal, so make sure you only do the withdrawals in sufficiently large amounts.

In the image above, the withdrawal fee is 0.0005 BTC, which is much higher than the actual transaction fee charged to include the transaction in the blockchain (probably done just to increase the exchange’s profits and minimize load on their withdrawal system).

A good system would be to try to keep the transaction fee lower than 1% i.e. withdraw BTC in chunks of 0.05 BTC or more. (If you buy a small amount every week, wait till the balance hits 100x the withdrawal fee, and then withdraw the coins to your wallet.)

Once the withdrawal is processed, you will now see the bitcoin reflect in your wallet!

Congratulations, you now have some bitcoin that you fully own and control.

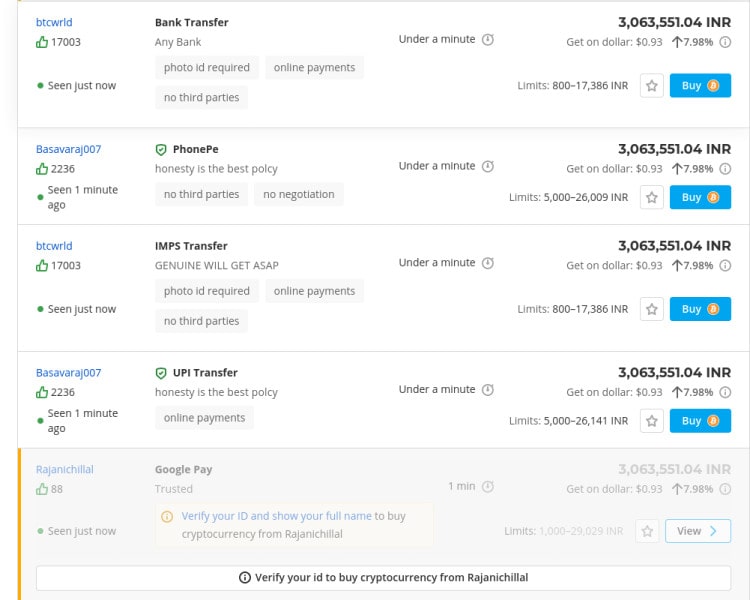

Buying Bitcoin Peer to Peer

Exchanges are not the only way to buy bitcoin. You can also buy them from other individuals on a Peer-to-Peer platform. The platform I recommend for peer-to-peer investments is Paxful.

The advantage of using a P2P platform is that many sellers will sell you bitcoin without needing any KYC or any form of identification.

Moreover, the distributed nature of P2P transactions has an inherent amount of privacy built into it that centralized exchanges simply do not have.

The other advantage is that you can use almost any payment method you can think of to buy your crypto – from Bank transfers, credit and debit cards, UPI, Google Pay, PayTM, and even things like Amazon gift cards, video game items, and cash in person. There are hundreds of supported payment methods.

The platform acts as an escrow and ensures that you don’t get cheated.

When you begin the trade, the bitcoin in the seller’s account is locked. You are given time to send them the money, and once the seller gets it, he can approve the transaction and the bitcoin will be added to your account.

In case of a dispute, you can send proof of payment to paxful and if it is satisfactory, they’ll release the bitcoin to your account.

In addition, the reputation score and review system strongly incentivizes them to be honest.

The only problem with P2P is that transactions take more time to complete as there is some coordination involved with the seller you’re buying from.

Transactions on exchanges are quick and fast (and usually slightly lower prices), but less private and have fewer payment methods available.

If you choose to go the exchange route for most of your purchases, I strongly recommend doing at least a few P2P transactions just to learn how it works.

Fun fact: I bought my first ever bitcoin on Paxful.

FAQ: Is Bitcoin Legal or Illegal in India

Short answer: Bitcoin is completely legal in India.

Long answer: There are no laws that say Bitcoin or any other cryptocurrency is illegal in any way, shape, or form in India.

Many people think crypto is “banned” in India because they came across some clickbait article that said so – but there are no laws passed banning crypto at this time.

All the articles saying “bitcoin will be banned” are saying so just because it’s a juicy topic that gets a lot of clicks, and not because there’s any substance behind those claims. I discuss exactly why these news websites produce such garbage in my piece on online news, which you can read here.

The only restriction that India ever had on crypto was for a period between early 2018 to March 2020, where the Reserve Bank of India (RBI) prohibited banks from providing services to the crypto industry.

This did not mean that crypto was illegal or “banned”, it only meant that banks would not provide services to the crypto industry.

In March 2020, the Supreme Court of India revoked this prohibition and allowed banks to provide services to the crypto industry.

To quote the Supreme Court judgement:

“The position as on date is that VCs [virtual currencies] are not banned, but the trading in VCs [virtual currencies] and the functioning of VC [virtual currency] exchanges are sent to comatose by the impugned Circular by disconnecting their lifeline namely, the interface with the regular banking sector. What is worse is that this has been done

(i) despite RBI not finding any thing wrong about the way in which these exchanges function and

(ii) despite the fact that VCs [virtual currencies] are not banned.

…

Therefore, in the light of the above discussion, the petitioners are entitled to succeed and the impugned Circular dated 06-04-2018 is liable to be set aside on the ground of proportionality.”

In other words, there are presently no restrictions in India on Bitcoin or other cryptocurrencies.

Cryptocurrencies are and have always been fully legal in India.

The fact that so many people think “bitcoin is illegal” only goes to show that what we really need are laws against fake and misleading news, not laws against crypto.

– Harsh Strongman