Here are some simple heuristics to follow when investing the equities portion allocation of your portfolio:

1. Not more than 5% in one stock and no more than 20% in one industry

This is fairly obvious – Diversification.

The higher the diversification, the lower the non-systematic risk.

Diversification makes your portfolio resistant to events that happen to single companies and industries – a management scandal, introduction to restrictive legislation in the industry, disruptive innovations, etc.

This also means that the impacts of positive events will be diluted. This is a fair price to pay for stability and risk management.

Don’t put all your eggs in one basket.

2. All the stocks you hold should pay dividends

This is where a LOT of people don’t agree with me but hear me out.

When a company pays regular dividends, the management HAS to keep the cash flows of the company in order; otherwise, they’ll have liquidity problems.

What does the CEO of a dividend-paying company do in the morning?

He wakes up and thinks to himself, “Everything better be in order; I have to pay Mr. Strongman his dividend”.

Meanwhile, the non-dividend-paying company’s CEO sleeps in late and doesn’t worry about the business nearly as much.

I find regular dividends to be a sign of good administration, and that’s where I put my money in.

From a risk perspective, your risk goes down as you get paid to hold the stock.

From a return perspective, the returns generated by dividends dwarf the returns generated by capital appreciation.

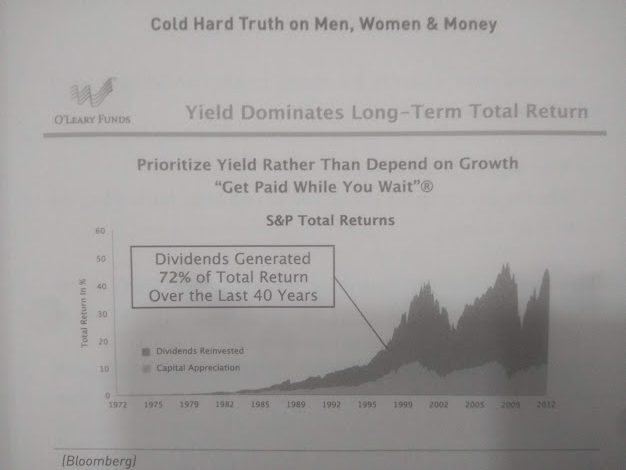

This is from the book “Cold Hard Truth on Men, Women, and Money” by Kevin O’Leary (India, UK, USA):

Dividends generated 72% of the total returns over the last 40 years.

72%.

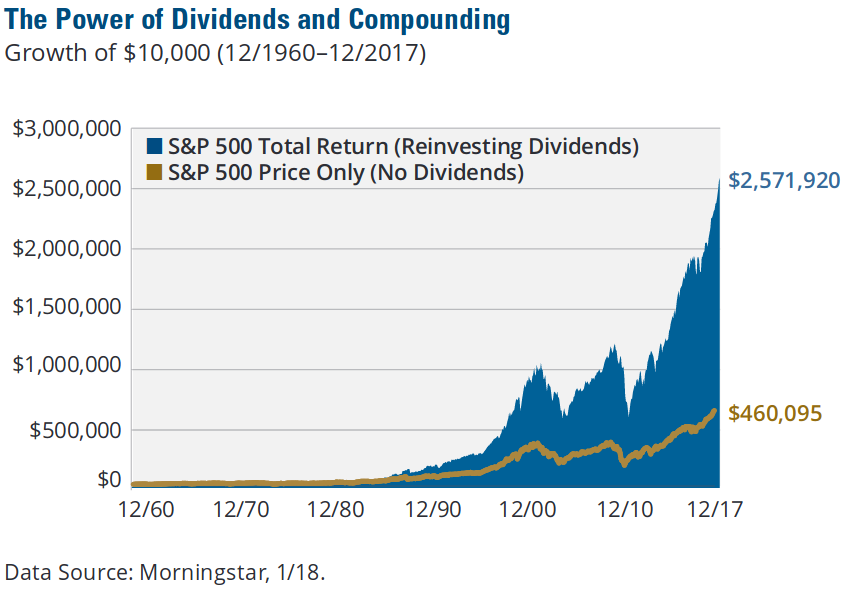

If that doesn’t get you to buy into the “only dividend-paying stocks” investment rule, I have another, more recent chart:

The above chart shows that 82% of the total returns came from dividends being reinvested – not from pure capital appreciation.

If that doesn’t convince you, nothing will.

Besides the above, if you live in a corrupt third world country, dividends become supremely important. Accounting scandals happen all the time; cases of promoters siphoning off assets to their closely held companies are rampant, and you can never really be sure if the financials you’re seeing are true and fair.

Feel free to disagree, but I’d say it’s prudent to invest in dividend-paying stocks – it’s the clearest sign that the business is cash flow positive.

(P.S. The dividend requirement does NOT apply to startups. This article is about investing in listed companies, not in small unlisted businesses.)

3. 5% of the portfolio should be invested in GOLD

Gold is insurance.

It’s a natural hedge against systematic risk.

Gold prices tend to be stable over time and rise in the event of a market crash, as more and more investors buy gold to protect themselves.

Unless you’re hyper-paranoid, you don’t need to buy physical gold. I personally buy Gold ETFs.

4. Up to 10% of the portfolio can go into risky bets

These are usually bets that have a high-risk, high-reward profile.

This part of the portfolio is exempt from the dividend-only rule.

Take risks, but take them smartly.

That’s all for the day, folks.

See you around.

Your Man,

Harsh Strongman

P.S. I have a very special guest post coming in for you next week – stay tuned.

Remember Warren Buffett’s investment analogy – Investing is like baseball without strikes.

You don’t lose by not swinging. You can wait as long as you want for a ball you think would be a home-run.

The real problem arises when you start telling yourself “hey bum, stop waiting, hit something.”

And then you end up making a shot you regret.

There’s nothing wrong with waiting for the right shot.

If you haven’t started investing yet, now is not the right time to start. As at the time of writing this article, in my opinion, the stock markets are soaring and heading for a crash in the near future.

It would be wise to wait until the eventual crash takes place before you start building your portfolio.

You have been warned.

Disclaimer: Although we are finance professionals, this is not professional advice. Talk with your consultants before making any decisions. Your decisions are yours alone.