1) The biggest financial mistake most men make is never starting a business.

You will never get anywhere working for other people. If you want to get rich, you must own equity. Without equity you are just a cog in the machine. With equity, it’s your machine.

This is by far the biggest mistake most men make. 99% of men think they are smart but if you’re so smart why are you so broke?

The answer is most guys would rather work harder at their job to get a pointless 5% raise than do the hard work of building an online business.

We’re in a world where building a business doesn’t cost much (you can literally get started with a few hundred dollars) so all the broke people deserve to be broke.

This is not the brick and mortar age where you need to spend $150k to open a store and buy inventory. You can learn a useful skill like web design and get started today if you choose to.

Most would rather work harder at their job never understanding that this is a dead end.

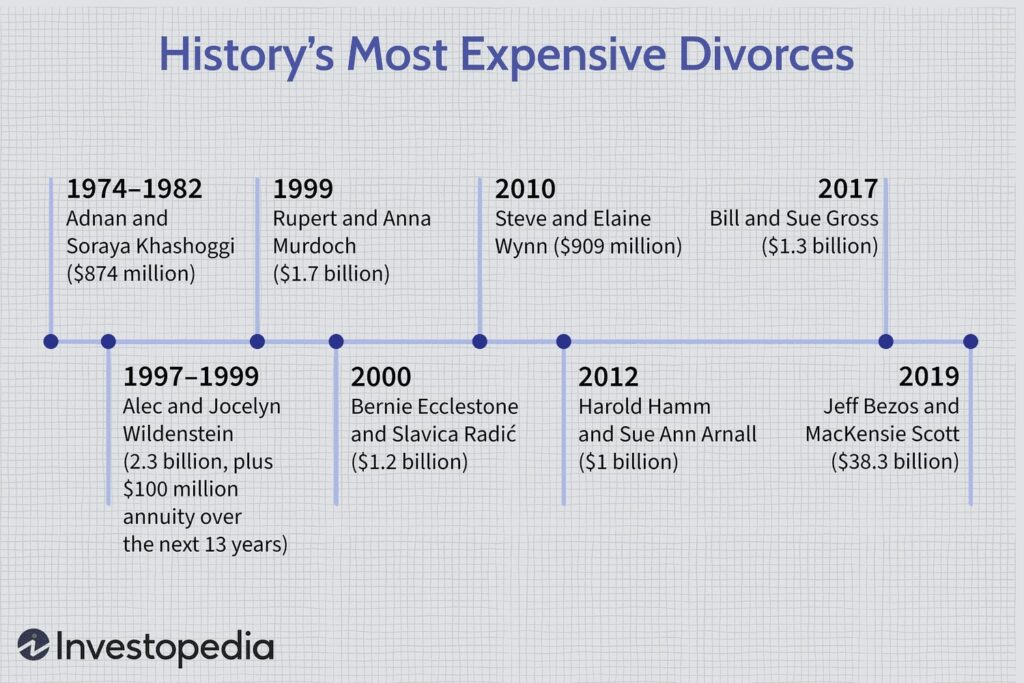

2) The second biggest financial mistake most men make is marrying the wrong woman and getting divorced.

Most men marry the first woman who likes them back. They hate to hear it but it’s true.

If you haven’t even dated a few girls before you committed, your girl likely is not one in a million but more like one in a hundred.

Sometimes it works out sometimes it doesn’t. When it doesn’t, the man loses half his net assets and a big chunk of his income for life. If he has children he loses them as well (often along with his sanity)

The family system is rigged against men, and that means that if you decide to marry, you must do it well. If you mess it up, you will lose out big.

3) The third biggest financial mistake most men make is dying with lots of money in the bank.

I see this all the time. Client works really hard in his life to make money. He is always careful with his money and never spends it. He is obsessed with saving every dime.

Then he dies leaving all the money in the bank.

What was the point of making the money then?

If you only make money but live like a miser and never enjoy life, you’re doing it wrong. You’re going to die sooner or later anyway.

You got to use the money.

Think of all the things you want to do – like travel, hiking, bucket list items, etc. – and do them.

Don’t wait till you’re dead to have fun. Twice a week, go and do something you want. It could be a new place you check out or a day hike – anything you want.

4) The fourth biggest financial mistake most men make is not teaching their children about money.

I see this all the time as well. Client was too busy with his job/business that he did not spend enough time teaching his children about money (and life in general).

When they die, they leave a large bunch of $$$ for their kids… who will 1) fight over their inheritance and 2) waste what they can.

First of all, you should always leave a will. It needs to be clear and should fully distribute your assets among your children.

When I say clear, I mean your will shouldn’t say things like “An appropriate amount should be given to my daughter Neha”. What is “an appropriate amount”? You gotta be clear and specific.

If you have a black sheep kid whom you want to leave nothing, leave them something like “my bible” so they cannot later claim you missed them by accident.

If you just leave them out of your will, they will later claim that they were missed by accident and dispute it in court.

Secondly, teach your children the value of money, how to make it (skills), and how to spend it for maximum return. If you don’t, they’ll just blow it all (you didn’t work so hard so your children could become party and drug addicts).

5) Alcohol can very quickly become your biggest discretionary expense if you get a drinking habit.

People can go from “drinking socially” to drinking expensive alcohol regularly very quickly if they’re not careful.

I have some clients who spend more on drinking than on rent. Think 40%+ of their income on different types of alcohol.

Alcohol is an extremely addictive substance, is terrible for your health, and is a complete waste of money. It’s one of the worst habits you can get yourself into.

The only thing it has going for it is that it’s socially acceptable. If you’re a porn addict, this is something you tell no one and hide it in shame (If you’re a porn addict, get Live Intentionally to get rid of it.).

If you’re an alcohol addict, you can act like you’re “the man” and be proud of it. This is largely the result of good marketing.

6) Your biggest costs will always be rent and taxes. If you want to save money, minimize those.

Other than the alcohol example above, 99% of the time, your biggest expenses are rent and taxes. If you want to save money, move somewhere where you have low rent and low taxes.

This can be hard to do if you’re a wage slave, but very easy to do if you have any kind of online business. Another reason to do everything you can to build something of your own than to work harder at your job for that 5% raise like a dumbass.

You will never get anywhere saving on little things like coffee and groceries like most average people do. At most you save 5% more overall.

On the other hand, you can literally halve your costs by chopping rent and eliminating taxes. It is a no brainer.

7) Business seems to be in people’s genetics.

Some clients are obsessed with it and will continuously be trying something or the other till one works out. Others are comfortable at their job and have accepted their fate as a servant.

In the long run, the guy obsessed with business will eventually find something that clicks.

Sometimes they go all in and become really rich ($20m+ and beyond) and sometimes they just build up to $20-30k a month and quit their day jobs to live leisurely lives. Different choices.

The wage slave guys lack the genetics to keep trying and push hard. Most just keep reading about business and success but don’t do any work (Forbes is popular with the masses, not the rich).

They can’t even send out decent cold emails for 3 months straight and just want to become successful without doing the work. The world does not work this way and they stay broke.

8) Women will generally find a man who makes 2-3x more than her. If the guy makes $100k, his wife will make $30k.

See this pretty much all the time. Women are smarter than men when it comes to marriage. They only look for guys who are significantly better than them.

Women evolved to seek resources and stability from marriage. Men evolved to seek health and fertility from women. The income discrepancy is our evolutionary natures playing out.

Once you understand this, you will realize that the biggest beta males in the world are rich men who have ugly or domineering wives (the man’s looks are irrelevant).

These guys were so desperate and beta that they traded gold for pig iron. Another reminder that money is not game.

9) Women spend more on experiences like travel and consumables. Men spend more on hard goods.

For example, women will pay for massages regularly. Men will buy an expensive computer.

This is largely because of genetic differences in thought processes.

Men have gone through intense selection pressure for millions of years. Men who planned well for the future were more likely to breed.

Women have not had nearly as much evolutionary pressure to think long term (other than finding a stable husband). This shows up in their spending habits.

Men think in terms of legacy and durability. What can I pass down? How can I get maximum return for my money? To men, money is a matter of winning or losing.

(Hint: this is why men rarely purchase drinks at expensive restaurants.)

Women think in terms of consumption and pleasure. How can I feel good? How can I enjoy what I have? To women, money is a lifestyle.

They are much more likely to pay for comfort and experiences than men are. Massages, good hotels, overpriced drinks at restaurants, expensive handbags, etc. are mostly female spending.

My main advice is that women need to think more about legacy and durability of their spending, and men should spend more on fun stuff (as said before, no point dying with millions in the bank).

10) Most men get bored as hell during retirement and deteriorate fast. Age 55-60 is much better for most than 61-65 because of this.

Again see this all the time. The only exception is when they really hated what they did and are just happy to have escaped it.

There’s not much to say about this except that you should continue doing some kind of freelance work after retirement just to keep the spirit alive.

If you don’t want to do freelance work, do any other kind of work you like to do. Like farming. The last thing you want to get used to is watching TV all day. That will kill you sooner than you think.

11) Getting rich is not about spending less but about making more.

You will not get rich cutting expenses (unless you’re really a spendthrift). You will get rich if you 10-1000x your income with online money.

There is no point arguing about this. The math simply does not work. You cannot get rich by saving money.

Who do you think is better off? Someone who saves every cent or someone who triples their income with online business? Of course the latter.

That said, you should always strive to minimize lifestyle inflation. At the same time, you must understand that you have a floor to how much you can save (can’t spend less than $0) but no ceiling to how much you can make.

12) Inflation is a tax on broke people because they have no assets. If you want to reduce wealth inequality, you need a deflationary economy so broke people can buy assets.

Just do the math.

Take two people, one with $1m in assets and $200k annual income, and another with $20m in assets and 100k annual income.

Say in 10 years the price of everything doubles due to inflation. To keep it simple, assume no savings, no taxes, and that wages keep up with inflation (already being generous here).

In the 10th year, one will have $2m in assets, $400k annual income while the other has $40m in assets and $200k annual income. The wealth inequality actually increased despite one guy having higher income.

This is why income taxes actually increase wealth inequality because it makes it impossible for people who don’t have assets to catch up.

The rich don’t care about income taxes. They have assets that inflate in value (no tax on that) and can live off investment returns alone.

This is also why even though everyone makes more money today than ever before, have working wives, fewer children than before and still struggle to buy a house.

While in the past people made little but a factory worker with a housewife and children could buy a house.

If you want to reduce income inequality, you need some kind of a property tax (highly unpopular) or a deflationary economy (will never happen for long no matter what politicians tell you).

13) Smart people minimize taxes legally from day 1. Dumb people do it illegally and eventually get caught.

All the smart people do it pro from the get go. This means incorporating in a low tax country, having the right business structure (eg. setting up a company where tax rates for companies are lower, etc.) and minimizing taxes as much as legally possible.

Dumb people do illegal stuff like hiding bank accounts, hiding revenue, etc. and eventually get caught. And that’s how you end up paying 5x more in tax liability, penalties, fees, collection costs, etc.

You gotta play within the realms of the law. If you don’t like the law, move your business to a place where you like the law – a choice that all modern internet based businesses have (this choice did not exist in the past).

I cover my personal recommendation in my crypto guide.

14) The bigger a woman’s job, the less likely she is to have children. Careers are the antithesis of children.

Women were not made for high stress corporate careers. It takes away all of their most fertile years of life (18-27).

Do you ever see a high power female lawyer or corporate executive with a husband and children? I don’t.

ALL of our female clients with high level corporate jobs worked really hard to get there, and that came at the cost of not having children and in most cases not even having a husband (boyfriends are not husbands).

If you have a daughter, and you want her to be happy in life, you need to teach her that family is more important than whatever perceived ego/status she will get from having a high power career.

15) Teach your children skills and leave them enough so they can do anything, but not so much that they do nothing.

So many clients make the mistake of leaving their children so much that the children become useless. You leave someone 5 rental flats and a bunch of investments and money… and no skills… what do you think will happen?

They become useless people who sit at home all day and watch TV.

Look what you need to do is spend your money while you are alive. If you want to benefit your children, get them 1-on-1 coaching (or group coaching) to teach them a variety of skills like programming, design, marketing, etc.

Essentially you want to leave your children with lots of skills, not just lots of money. They will figure out how to make money from the skills.

If you just leave them money, you are their enemy in disguise because you have taken away their will and motivation to be better (Let’s be real, money is the motivator for 99% of people and is the reason why you know English but not Swahili. If you could get paid big by knowing Swahili, I bet you’d be trying to learn.).

BONUS) Money is a man made concept.

Good to have more of it, but you must remember that it’s still like a video game score (after a point).

Some clients will prioritize getting money so much that they will lose sight of everything else.

I mean they will allow themselves to become obese, have zero muscle, spend little to no time with their wife and children, have zero hobbies, and rarely do any interesting travel (other than boilerplate tourist stuff).

Then they have a massive heart attack and die in their 50s and 60s.

What a waste. You gotta keep your priorities straight. Truth, health, family, money, power, and influence. In that order.

That’s all for today.

Until next time.

Your man,

Harsh Strongman

![Traits Women Find Attractive Traits Women Find Attractive (And How to Score Yourself) [PART 1: Physical Aspects]](https://lifemathmoney.b-cdn.net/wp-content/uploads/2025/11/Traits-Women-Find-Attractive-1.jpg)