“In the beginning, God created the bank and the money. And the bank was without money, and bailed out; and darkness was upon the face of the taxpayer.” – Genesis 1:1

Just kidding. The evolution of modern money is a long and interesting one and took place over tens of thousands of years.

The Motivation

Humans are not self-sufficient. We cannot exist in isolation. In other words, we need things other humans provide, and we provide things other humans need.

Let’s go back to the beginning. You’re a hunter-gatherer caveman. You hunt animals, maybe catch some fish if you’re near a river or a lake or the coast, and then you bring the meat back to your tribe. You have satisfied one of your needs – nourishment.

But hey, you have other needs too. For example, you have a biological need to seek sex and reproduce. You see a cavewoman, who is physically weaker and thus needs protection and someone to provide her with meat.

So what do you do? You regularly offer protection and some of that food you captured to one of those cavewomen, and in exchange, she gives you sex and children.

Pretty simple right? You give something you have in order to get what you want. This is called an exchange.

The “something” in an exchange can be anything – goods, services, or even just an agreement to provide goods and services in the future (for example, “craft me a spear, and the first three deer I kill with that spear will be yours”).

The Barter System

Well, over time, we stopped being cavemen who relied on hunting and gathering for food. We took up agriculture.

Agriculture was a major change to human civilization – we could finally start settling down at one place and grow our own food. We even learned to domesticate animals, so we didn’t need to hunt for food.

Over time, as we settled down and formed society, something interesting happened. Our wants increased, and our labor became specialized.

Instead of everyone doing everything, some people became farmers, some raised animals, some become doctors, some became barbers, some became fishermen, other soldiers, etc. – in other words, people started picking their occupations.

This was a good thing as it greatly increased productivity among people and increased the quality of goods produced. Fishermen became extremely good at fishing as they spent most of their days fishing, carpenters became very good at crafting furniture, potters made great pots, etc.

The only problem was – how does the farmer get fish, how does the fisherman get pots, and how does the potter get furniture for his house?

Here is the simple solution: they exchange their goods and services with each other directly (remember, currency still hasn’t been invented yet). This is called the barter system.

“In trade, barter is a system of exchange in which participants in a transaction directly exchange goods or services for other goods or services without using a medium of exchange, such as money.” – Wikipedia

The farmer needs fish, so what does he do? He goes to the fisherman and makes an exchange with him. He gives the fisherman a small wheat bag, and in return, the fisherman gives the farmer some fish.

The potter barters some of his pots with the farmer and the fisherman to get some wheat and fish. The barber, carpenter, etc. do the same thing – they offer their services in exchange for the goods they want.

The exchange ratio (how much fish for how much wheat, how many haircuts for how many fish, etc.) were determined based on demand and supply in that particular village. In a year with bad rainfall, there will be little wheat available, and thus the fisherman will have to give more fish to get the same amount of wheat, etc.

This system worked and was dominant for a long time – from prehistoric times to just a few thousand years ago. It is still in use today in parts of the world where people have lost faith in their government’s currency due to hyperinflation.

The barter system, however, has several limitations:

1. No common measure of value: Each good or service was pegged to several other goods and services. For example, 1 bag of wheat could be exchanged for 2 fish, or 5 haircuts, or 4 pots, etc., and there was no unified measure of value.

Today we measure all goods and services with one common measure – the currency of that particular country.

2. The need for double coincidence of wants: Both parties need to want what the other has to provide. For example, if you were a potter and wanted fish – you better hope that the fisherman needs pots. If the fisherman doesn’t want pots, you would have no option but to go without fish.

3. Indivisibility of certain goods: Let’s say you have a goat that you want to exchange for some pots. 1 goat buys 10 pots. But you only need one pot. So what now? You can’t chop the goat into 10 parts and give the potter one of them – because that will kill the goat. You’re stuck.

4. Lack of standards for deferred payments: For credit transactions, there can be many disputes regarding the quality and value of the goods or services used in the final settlement.

For example, let’s say you’re a barber and you agree with the farmer that you will provide the farmer’s family with haircuts for one whole year, and at the end of the year, the farmer will give you a horse from his stables.

Sounds good, right? Except when the year ends, the farmer gives you this old horse that’s not got many years left. It’s still a horse, but it’s less valuable than a young horse. Because of problems like this, it was challenging for people to do credit transactions.

5. Problems of storage: Let’s say you work hard as a fisherman and catch lots of fish. How do you store wealth? You can’t just keep the fish for long periods because they’ll spoil. Food and other perishable products spoil. There was a problem of storing wealth for long periods.

Commodity Money

As you might have guessed, many of the problems listed above are solvable by using a widely consumed commodity that is always in demand and can be exchanged for other goods.

For example, the Romans used salt. Salt is easily divisible, non-perishable (can be stored for a long period of time), limited in quantity (it was expensive and labor-intensive to produce), and widely consumed by everybody.

In Ancient Rome, salt had to be mined from the Earth and was hard to come by.

People would keep and store a reserve of salt in their homes for both day-to-day transactions and future emergencies. Roman soldiers were partly paid in salt. This used to be called “salarium” (sal means salt) and is the origin of the word “salary”.

Different places had different commodities that people used as money, some examples being:

- Cattle in India

- Salt in Rome

- Tobacco in Virginia

- Rice in Carolina

- Cowry Shells in Africa

- Sugar in Brazil

- Tea in Mongolia

It is worth noting that just about anything can be “money” as long as enough people accept it in exchange for their goods and services.

Money does not have to be backed by a government to be considered money.

This is a good system and builds on top of the existing barter system. However, it does have its limitations:

1. Storage issues: Some forms of commodity money, such as cattle, are difficult to store in one place. They also have to be maintained (fed and given water) and can’t be passively stored. Some forms of commodity money like cowry shells are fragile and need to be stored and transported carefully.

2. Difficult to transport over long distances: This is a general problem with physical money.

3. No universal acceptability: The main problem with this form of money is that it’s not universally accepted. Different climates affect the perishability of different commodities in different ways, and different geographical locations have different levels of scarcity for different commodities.

Salt was valuable in Rome (where it was scarce) but useless when trading with India because India is a salt-rich country.

Butter made good commodity money in cold countries but was useless when trading with hot countries.

4. Perishability: Some forms of commodity money, like cattle and food items (rice, tobacco, sugar, etc.), deteriorate over time or get damaged by pests and lose value.

Metallic Money

Eventually, humans learned to dig deeper and found metal ores. Metals were used for many things like making swords and shields, armor, and tools of all types (i.e. they had value in use).

Metals were inherently valuable (since they had value in use), highly durable, divisible (and unitable), fungible, homogeneous, and it was easy to verify their purity by melting them.

Eventually, people started using metals as money. (Note: Metallic money is just a form of commodity money.)

Metals were scarce across the globe and weren’t too climate-dependent, so they had universal acceptability.

The downside to metals is that they are heavy.

Gold Backed IOUs (Non-Legal Tender Paper Currency)

Precious metals like gold were very valuable and had to be kept safe from thieves.

To prevent theft, people would leave their gold with a goldsmith. The goldsmith accepted gold deposits for a fee and issued I.O.U.s (short for I owe you) for the weight of the gold.

Anyone could take an IOU note to the goldsmith and get their gold back whenever they wanted. As trust in the goldsmith grew, people would accept the IOU as payments as if it was actually gold (instead of an obligation to give gold).

The IOUs derived their value from the gold the goldsmith was obligated to exchange for them.

This is a form of paper currency and had some of the same problems that paper currencies have today – debasement.

These goldsmiths eventually realized that not everybody came to claim their gold at one time, and they always had a healthy balance of people’s gold deposited with them. They just started creating fake I.O.U.s that wasn’t backed by any gold with them and spent these I.O.U.s.

Eventually, the ratio of the gold obligated to be repaid to I.O.U. Holders and the actual gold they had in the vault kept deteriorating, and occasionally, the goldsmiths who feared being caught and punished would disappear overnight along with all the gold in their vaults.

The IOU holders would be left holding worthless pieces of paper.

Legal Tender Coinage

The problem with metallic money was that fraudsters would cheat the public either in purity or weight.

Fraudsters would mix precious metals with less precious metals and pass them off as being pure.

The governments of those times (kings, emperors, etc.) took it upon themselves to solve this problem by taking control of metallic money minting.

The king’s mint would create coins and stamp them with the king’s emblem or whatever other symbols the king saw fit. The emblem guaranteed the weight and purity of the metal used to make that coin.

This improved trust and helped improve trade and commerce.

The only problem was: It was centralized.

The central authority (kings) was not fair and would debase the currency whenever they needed money (this is a universal problem with centralized money).

Let’s say the king fought a war and lost. The war was expensive and had no spoils. The king still needs to pay soldiers 1000 gold coins. But he checks his treasury and discovers that he has only 800 gold coins with him. So what does he do?

He melts the 800 gold coins, adds in 200 melted copper coins, and uses that to mint 1000 “gold” coins – which are used to pay off his soldiers.

This way, the money supply kept increasing, and the value of precious metals in the coins kept going down.

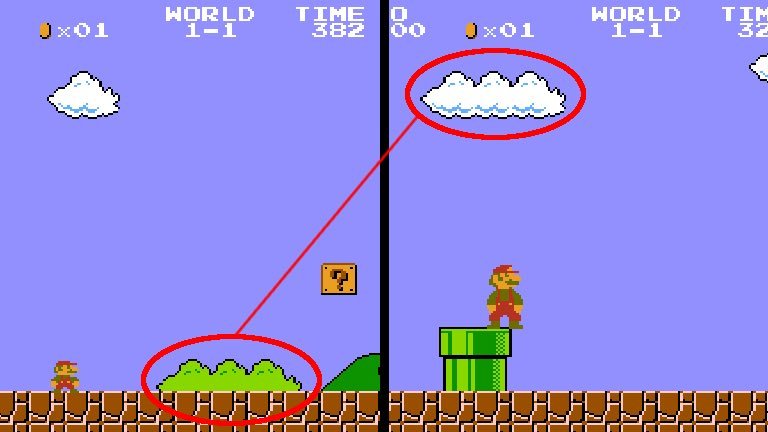

The rapid decline in the purity of Antoninianus, a Roman coin.

This practice of debasement is horrible for trade and the economy as it hurts trust in the currency, deteriorates international trade, and causes inflation problems in the domestic economy.

Paper Money

Paper money was invented by the Chinese. At that time in China, the official government currency had a copper coin that had a square hole in between, so people could string them together.

Rich merchants found it difficult to use these heavy strings of coins, especially for large transactions – so they would leave their coins with a trusted agent who would record their balance in a ledger and issue paper promissory notes, which could then be used as a currency. When the final holder of the promissory note returned it to the agent, the agent would give back the coins to the person. (Kind of like the IOUs above.)

Paper money was easy to store, easy to transport, easy to carry, easily divisible into small units, and was not perishable.

Eventually, the Chinese emperors of those times realized the economic advantages of having a paper currency (easy to make, easy to carry, etc.) and eventually issued a nationwide paper currency standard backed by gold or silver. The currency note had an inscription stating its value and a warning that counterfeiting was punishable by death.

This currency was legal tender (Legal tender is anything recognized by law as a means to settle a public or private debt or meet a financial obligation, including tax payments, contracts, and legal fines or damages).

Once again, the recurring problem of centralized currencies started to show: they printed too much of it.

Whenever the state needed money, they’d print more currency. Eventually, this led to oversupply and hyperinflation. The currency became worthless. Consequently, China discontinued the use of paper currency in 1455. The Chinese would not adopt paper currency again for hundreds of years.

| What is the difference between Money and Currency?

Most people do not know the difference between money and currency. Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The main functions of money are distinguished as a medium of exchange, a unit of account, a store of value, and sometimes, a standard of deferred payment. Any item or verifiable record that fulfills these functions can be considered as money. A currency in the most specific sense is money in any form when in use or circulation as a medium of exchange, especially circulating banknotes and coins. A more general definition is that a currency is a system of money (monetary units) in common use, especially for people in a nation. Money is intrinsically valuable and is a store of value. Currency is a monetary unit used as a medium of exchange and usually refers to banknotes and coins. Currency itself has no intrinsic value. For example, gold is money since it fulfills all the criteria of money, including being a store of value. But when you try exchanging gold for something, people will use a currency like the Rupee to determine how much gold needs to be exchanged. For example, if one gram of gold is worth ₹4,000 rupees, and you’re buying something that costs ₹10,000 – you will give 2.5 grams of gold. The monetary unit used was Rupee. Note: Gold was money, and gold coins were currency during the times of metallic money. |

Adoption of Paper Currency in the United States

(Off-topic)

As trade, commerce, and prosperity grew in colonial America, a shortage of gold and silver coins was felt.

On February 3, 1690, the Massachusetts Bay Colony issued the first paper money in the USA (denominated in pounds). Printing money was an easy way to create money, as all that was needed in its creation was ink and paper. Eventually, each colony (except Virginia) had issued its own currency.

The paper currency (called colonial scrip) was denominated in pounds, and the value varied from colony to colony. A Massachusetts pound was not equivalent to a Pennsylvania pound. All colonial pounds were of less value than the British pound sterling.

However, the colonies printed too much of the paper currency, which caused inflation and caused drastic declines in the value of these local currencies. People hoarded gold and silver to protect their wealth from being inflated away.

The British parliament later put an end to the colonies printing money with a series of Currency Acts.

Later, when America wanted independence and started the American Revolution. How did they fund it? They created paper money. The states issued paper money, and the Continental Congress issued its “Continental Dollar”.

But soon, they printed too much of it, and both the State and Continental dollar became worthless by the end of the war.

(Dear reader, are you noticing a pattern here?)

After the war, the USA created the United States Dollar, the one we use today.

It was initially based on the Gold Standard, i.e., its value was directly linked to gold. The dollar was a representative currency and represented actual gold and silver the government had in its vaults. (However, this is no longer the case.)

As the economy fluctuated and problems arose that needed funding, the government printed more money, effectively reducing the amount of gold each dollar was worth.

For example, before the 1929 crash, one ounce of gold was to be worth $20. However, the government had to print a lot of money in its attempts to get out of the great depression, and in 1934, one ounce of gold was set to be worth $35.

Cutting this story short (which you can read more of here), many countries started cashing in dollars for actual gold, which led to the collapse of the Gold Pool. In August 1971, the US government put an end to the direct convertibility of gold to dollars. This was the Nixon Shock.

Effectively, the US dollar was now a fiat currency.

Fiat Money

Fiat money is a currency established as money by government regulation.

It is not backed by any physical commodity, nor is it made of any substance of value, so it does not have intrinsic value and does not have value in use (inherent utility, like that of a bull or a barrel of salt).

It has value only because a government maintains its value by controlling the money supply through a central bank or because parties engaging in exchange agree on its value.

This is the system followed by virtually all countries today.

It has the same problem that all centralized currencies have: the people in control print too much, inflating its supply, and the purchasing power (the amount of stuff each unit of the currency can buy) of the currency keeps dropping.

Plastic Money

Storing all these paper notes in your home is risky (they can be lost by theft, by fire, etc.) so we now have these banks where we can keep our money in.

Moreover, it’s quite difficult to carry lots of notes everywhere and have to make change, etc. It sure would be nice if we could spend money directly from the bank, wouldn’t it?

Well, the bank gods have answered: With little plastic cards like debit and credit cards, you can do just that!

ATM cards, debit cards, credit cards, etc. are all plastic money. They make it easier to do day to day transactions, especially online.

Digital Currencies

Ever since computers and the internet became a thing, people have wanted to create a fully digital currency.

Several attempts have been made, for example, E-gold, 12 years before Bitcoin.

There is an inherent difficulty with creating a digital currency that is unique to the digital world: replication.

For example, if I give you a physical dollar, I have lost a dollar, and you have gained it. But if I email you a file, you have the file, but I have an identical copy too. I have not lost the file. I could just as easily send the same file to multiple people.

How do you create a system where if one person spends his digital currency, he can’t then go and spend it again?

This is called the double-spending problem.

The way that early digital currencies were used to solve the double-spending problem was to have a central organization that verifies the legitimacy of transactions.

You could send money to someone else, but that could only be done through the central organization. If you tried to send that same money twice, the central organization wouldn’t let you, since it knows that you’ve already spent the money.

This system works, but it is centralized and has a single point of failure: the central organization.

Hackers would target the central organization of these early digital currencies, worried governments would litigate and shut them down, and sometimes the parent company would suddenly liquidate and make the system worthless.

What was needed was a decentralized system that solved the double-spending problem. A decentralized system could not be targeted by a government (via litigation) or a hacker, and it wouldn’t have a parent company by definition.

Enter Bitcoin.

Bitcoin is a decentralized digital currency that solved the double-spending problem using blockchain and proof of work system and is all the rage today.

We shall be learning more about Bitcoin in our free crypto course.

That’s all for this piece!

Hope this helps.

Your man,

Harsh Strongman

P.S. If you’re here from the Teach Yourself Crypto course, I’m one of the authors. Do leave a comment telling me how you found out about the course and a bit about your background. It helps us target the curriculum better.

References (and recommended readings): Barter to Bitcoin by Ravin Aarya

![Traits Women Find Attractive Traits Women Find Attractive (And How to Score Yourself) [PART 1: Physical Aspects]](https://lifemathmoney.b-cdn.net/wp-content/uploads/2025/11/Traits-Women-Find-Attractive-1.jpg)